Future Lucid vehicles will increasingly use natural and high-performance synthetic materials mined and produced at Syrah Resources and Graphite One’s facilities in the U.S., the company said.

EV maker Lucid Group, Inc. (LCID) on Wednesday announced the signing of a multi-year supply agreement with Graphite One for American-sourced natural graphite.

The agreement aims to strengthen the company’s supply chain for American raw materials and resources amid the Trump administration’s push to strengthen American manufacturing and supply chains.

Future Lucid vehicles will increasingly use natural and high-performance synthetic materials mined and produced at Syrah Resources and Graphite One’s facilities in the U.S. as part of directed supply agreements with the company’s battery cell suppliers, Lucid said.

Interim CEO Marc Winterhoff stated that the contracts will enhance the company’s independence from external factors or market dynamics.

Under the multi-year agreement, Graphite One will supply Lucid and its battery cell suppliers with natural graphite, with production expected to begin in 2028. The natural graphite will be sourced from the Graphite Creek deposit north of Nome, Alaska.

Lucid had announced an agreement with Graphite One last year for synthetic graphite sourced from the latter’s proposed active anode material (AAM) facility in Warren, Ohio, for future vehicles starting in 2028.

Graphite One CEO Anthony Huston said that the two deals complement each other.

Syrah Resources is also expected to supply natural graphite active anode material to Lucid starting in 2026, sourced from its AAM production facility in Vidalia, Louisiana.

Graphite, both synthetic and natural, forms a significant amount of the material within Lithium-Ion batteries and is essential for fast-charging performance.

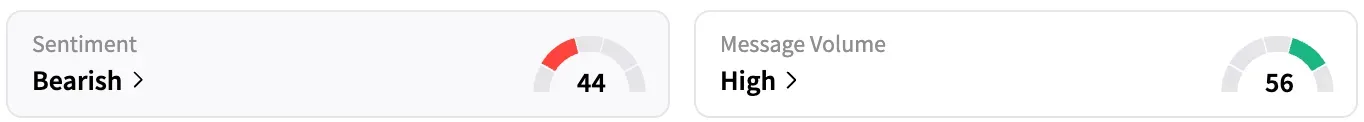

On Stocktwits, retail sentiment around Lucid remained unmoved within the ‘bearish’ territory over the past 24 hours, coupled with ‘high’ message volume.

A Stocktwits user expects the stock to hit $3 in the coming months.

Another optimistic user expects it to hit $5 this week.

LCID stock is down by about 28% this year and by about 24% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<