The analysts see further downside risk if ₹1,340–₹1,360 fails to hold.

Lodha shares faced a sharp selloff on Wednesday, following a large block deal. It fell over 6% after 14 million shares traded in a block deal in early trade. Equity worth $165 million was offloaded at a floor price of ₹ 1,384.60, which was at a discount.

SEBI-registered analyst Vijay Kumar Gupta noted that while its long-term growth narrative remains supported by steady pre-sales and a strong pipeline, near-term volatility is expected, and advised caution on the stock as the recent block deal triggered a supply-side shock.

On the fundamentals, Lodha reported 10% growth in its Q1 FY26 pre-sales, showing strong demand traction. The real estate major has added five projects with a gross development value (GDV) of ₹22,700 crore.

Lodha has also recently raised ₹650 crore via non-convertible debentures, indicating ample liquidity to use for expansion plans.

The company is set to declare its June quarter earnings (Q1 FY26) on July 26. And it had declared a ₹4.25/share dividend, with record date set for Aug 22.

Technical Trends

On its daily chart, Lodha stock has seen a sharp bearish candle with heavy volume. The high momentum drop indicates an institutional exit, according to Gupta.

Other technical indicators also indicate weakness. Its Commodity Channel Index (CCI) stands at -102, a deep oversold zone. The TTM Squeeze shows fading momentum, while its Chaikin Money Flow (CMF) at -0.38 signals outflow.

Gupta identified support at ₹1,305, ₹1,265, with resistance at ₹1,390 and ₹1,404. He advised traders to avoid fresh long positions until price reclaims ₹1,390 with volume confirmation. Short-term traders may consider ₹1,305–₹1,320 zone for reversal signs.

Analyst Sunil Kotak highlighted that the stock saw a huge volume-driven selloff, and that its Relative Strength Index (RSI) stands at 40, indicating bearish sentiment. He sees a significant demand zone at ₹1,340-₹1,360, and if the stock closes below this, we could see further downside.

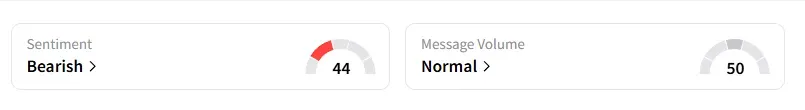

Data on Stocktwits shows that retail sentiment turned ‘bearish’ a day ago.

Lodha shares have declined 2% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<