Retail sentiment turns ‘extremely bullish’ ahead of results. Analyst flags ₹4,500 as the critical level to watch for confirmation.

Investors are hopeful that L&T Technology Services (LTTS) will lift sentiment, which the weak quarterly results from IT peers Tata Consultancy Services and HCL Technologies have subdued.

The Vadodara-headquartered company is expected to kick off fiscal 2026 with its first-quarter earnings report later today.

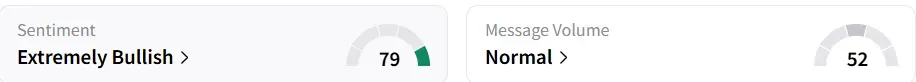

Retail sentiment on Stocktwits turned ‘extremely bullish’ ahead of its Q1 results. It was ‘bullish’ a day earlier.

L&T Tech is showing signs of consolidation ahead of its Q1FY26 results. After rallying from its key support zone of ₹4,050 - ₹4,200, the stock is trading in a tight range, noted SEBI-registered analyst Rohit Mehta.

A breakout above ₹4,500 could trigger bullish momentum toward its all-time high resistance of ₹5,928.50, making this a key level to watch, he added.

On the fundamentals front, LTTS has witnessed mixed Q4 and FY25 results, with revenue rising 17.5% year-over-year and 12.4% sequentially. However, operating profit declined both sequentially and annually, reflecting pressure on margins.

Valuation also remains a concern, as the stock is trading at 7.62 times its book value.

However, the company has a three-year average ROE of 25.3% and a consistent dividend payout ratio of 42%.

Promoter holding remains stable at 73.66%. Foreign institutional investors (FIIs) increased their stake from 4.19% to 5.18% over the last quarter, but domestic institutional investors (DIIs) slightly trimmed their exposure from 14.30% to 13.67%.

The analyst recommends waiting for a volume-backed breakout to confirm trend reversal.

At the time of writing, the stock was trading marginally higher at ₹4,379.30, having declined by 7.4% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <