The partnership, struck in March last year, allowed the sale of Krispy Kreme’s donuts in McDonald's outlets in the U.S.

Krispy Kreme's (DNUT) move earlier this week to end its partnership with McDonald's (MCD) is largely priced into the donut seller's shares, and investors should "remain on the sidelines until the dust settles," an analyst said.

The termination was largely expected after Krispy Kreme said in April it was reassessing the deployment schedule and cost-sharing for the program together with McDonald’s.

The partnership, struck in March last year, allowed the sale of Krispy Kreme’s donuts in over 14,000 McDonald's stores in the U.S. The scheme could only be rolled out to 2,400 McDonald’s restaurants before the two sides launched a review.

"While disappointing, this news was largely expected after a pause to the partnership was announced in April," Truist said in an investor note, according to The Fly.

The investment firm, which maintained its 'hold' rating on DNUT shares, stated that Krispy Kreme could leverage the capital expenditures made on the partnership; however, its margins are likely to decline before returning to 2024 levels.

Krispy Kreme stock lost only 0.7% on Tuesday following the announcement and shed 1.16% on Wednesday, before rebounding in after-hours trading.

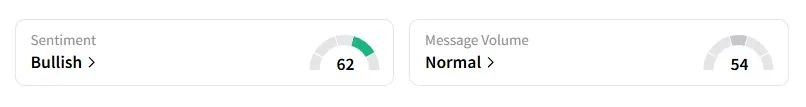

On Stocktwits, the retail sentiment for Krispy Kreme was 'neutral,' unchanged from a month ago.

A user said: “Bet a lot of new eyes were on this today after the news. I’m cautiously bullish at this price.”

Along with announcing the pause in April, Krispy Kreme suspended its full-year forecast as well as dividends, causing its shares to tumble 25%. The company has said it is working to pay down debt, de-leverage the balance sheet, and drive sustainable, profitable growth.

The donut brand is one of the more notable casualties of consumers scaling back discretionary spending amid challenging economic conditions. Its shares are down 74% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<