Beyond technical indicators, the company’s long-term outlook is supported by strong earnings performance and solid asset quality, marked by significantly low levels of bad debt.

ICICI Bank’s stock has been showing strong buying interest on both daily and weekly charts, with technical indicators strengthening its bullish prospects.

According to SEBI-registered analyst Deepak Pal, the stock’s daily chart shows the formation of a double bottom pattern, with strong support levels at both the 14-day and 55-day exponential moving averages (EMA).

Last week, strong buying momentum drove the stock near its lifetime high of ₹1,471.50, last seen in May, the analyst said. Following a short-term correction after reaching record highs, the stock experienced a reversal from its low of ₹1,404.80 on June 19.

Even during the correction phase, Pal observed that the stock consistently found support near its 55-day exponential moving average (EMA), holding the crucial ₹1,400 level. The support proved critical as the stock climbed to near-record highs last week, closing at ₹1,462.20 on Friday.

At the time of writing, ICICI Bank shares were trading at ₹1,451.30.

In the short term, the stock remains above its 14-day EMA, which is currently around ₹1,425, which signals strength in its upward trend, Pal said.

Overall, Pal recommended a “buy on dip” strategy, with ₹1,400 as a key support. If the current momentum continues, the stock is well-positioned to form higher highs and may soon test the ₹1,500 level in the near term.

ICICI Bank is among India’s largest private sector banks. Its fundamental outlook remains healthy. In Q4 FY25, the bank reported a 19.2% increase in standalone net profit to ₹12,200 crore, along with a strong loan and deposit growth of about 14-16%, and a CASA ratio of around 39%.

ICICI Bank’s net interest margin rose to 4.4%, while its asset quality stayed strong with net NPA levels at just 0.42%.

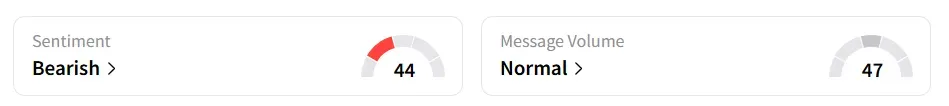

However, the retail sentiment on Stocktwits for ICICI Bank turned ‘bearish’ from ‘bullish’ a day earlier.

The shares have gained over 13% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<