HIMS CEO said that the pharma company’s commercial team has been increasingly pressuring the company to control clinical standards and steer patients to Wegovy regardless of whether it is clinically best for patients.

Hims & Hers (HIMS) CEO Andrew Dudum on Monday expressed disappointment at Novo Nordisk’s (NVO) decision to cancel its collaboration with the telehealth company earlier in the day.

Hims stock was down nearly 32% at the time of writing.

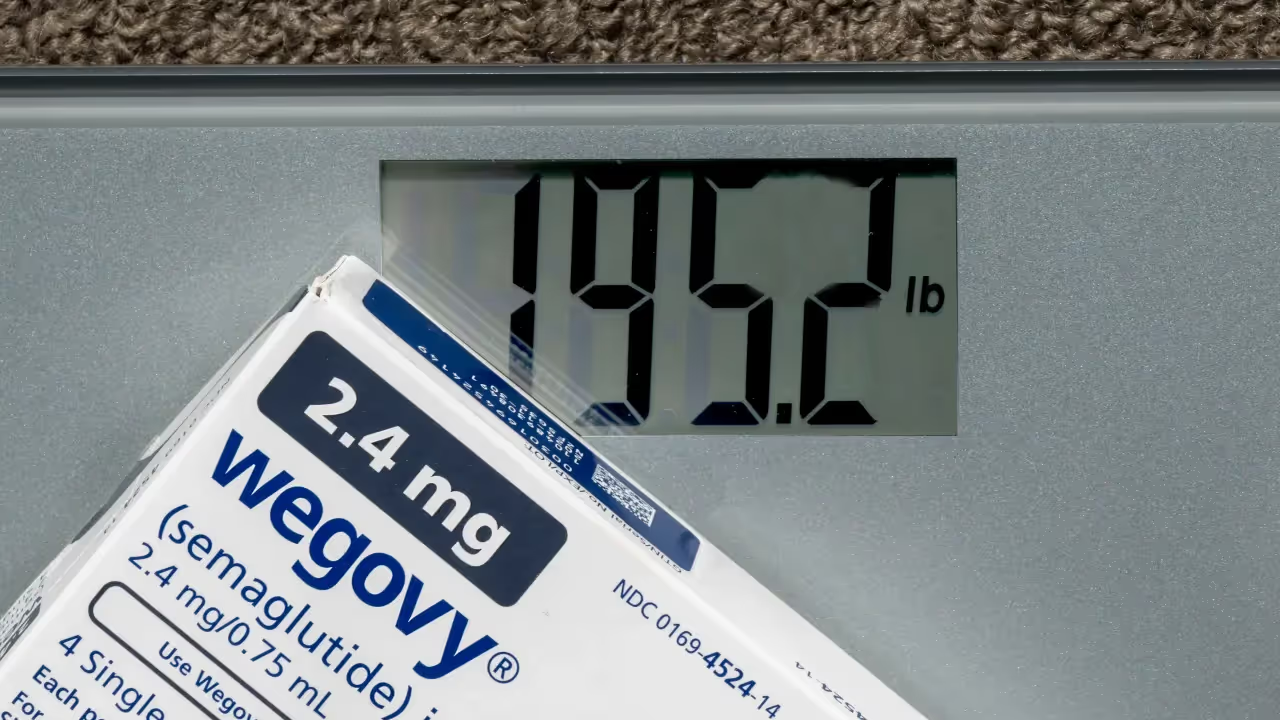

Novo on Monday morning announced that it is halting its collaboration with the telehealth company for the sale of its blockbuster weight loss drug Wegovy.

Novo said that Hims & Hers failed to adhere to the law, which prohibits mass sales of compounded drugs. It alleged that the telehealth operator is promoting and selling illegitimate, knockoff versions of Wegovy and has hence decided to halt the collaboration.

Dudum, however, alleged that Novo management is “misleading the public.” The CEO said in a post on X that the pharma company’s commercial team has been increasingly pressuring the company to control clinical standards and steer patients to Wegovy regardless of whether it is clinically best for patients.

“We refuse to be strong-armed by any pharmaceutical company’s anticompetitive demands that infringe on the independent decision making of providers and limit patient choice,” Dudum said.

The CEO said that the company takes the role of protecting the ability of providers and patients to control individual treatment decisions extremely seriously, and will not compromise the integrity of its platform to appease a third party or preserve a collaboration.

Following the news of the failed collaboration, Needham downgraded Hims & Hers (HIMS) to ‘Hold’ from ‘Buy’ and removed the firm's prior $65 price target.

The firm believes HIMS is now at a competitive disadvantage as both Eli Lilly (LLY) and Novo maintain partnerships with its competitors, and it believes shares are likely to be range-bound while the legality of HIMS’s personalization practices is determined, the analyst told investors.

Citi also thinks Hims & Hers' legal risk "increases substantially" with the cancellation of the collaboration.

However, from a financial perspective, the firm does not think this will have a significant impact on Hims & Hers' fiscal 2025 results. It estimates the vast majority of Hims & Hers' $725 million weight loss revenue will still come from compounded semaglutide.

Citi keeps a ‘Sell’ rating on the shares with a $30 price target.

While NVO stock is trading down 19% this year, HIMS stock has gained 81%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<