The company expects first-quarter gross merchandise value and revenue growth to be weaker than the fourth quarter.

Grab Holdings’ (GRAB) stock fell 11.4% in aftermarket trade on Wednesday after the company’s 2025 revenue projections fell short of Wall Street’s estimates.

The Singapore-based company forecast 2025 revenue between $3.33 billion and $3.40 billion on a constant currency basis. According to FinChat Data, the midpoint of the revenue outlook was below analysts’ expectations of $3.39 billion.

The company’s fourth-quarter revenue rose 17% to $764 million, topping the Wall Street estimate of $756.7 million.

Grab’s on-demand gross merchandise value (GMV), which denotes the total value of the transactions on the app, rose 20% to $5.03 billion during the quarter.

The company’s monthly transacting users (MTU) count jumped to 43.9 million from 37.7 million in the year-ago quarter.

Grab offers a wide range of services, including food deliveries, online ride booking, and financial services. The company operates primarily in Southeast Asian countries, such as Indonesia, Singapore, and Malaysia.

The company’s deliveries segment revenue grew 13% to an all-time high of $407 million, aided by a rise in GMV and MTU.

Grab’s mobility segment revenue jumped 19% to $282 million, with more customers using its Saver transport rides.

Its loan portfolio jumped 64% to $536 million at the end of the quarter, leading to a 38% rise in financial services segment revenue.

The company expects first-quarter GMV and revenue growth to be weaker than the fourth quarter due to the impacts of the Lunar New Year and the Ramadan fasting period. Grab added it expects a sharp recovery in the second quarter.

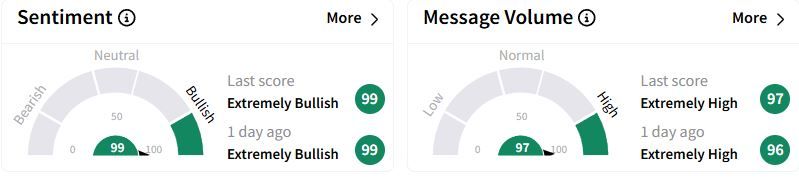

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ (99/100) territory, while retail chatter continued to trend in the ‘extremely high’ zone.

One user commented the traders might be overlooking the earnings report and focusing more on the revenue outlook.

Earlier this month, several media outlets reported that the company was in talks with Indonesian rival GoTo over a possible merger amid heightened competition.

Over the past year, Grab stock has gained 50%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<