According to a report by DealStreetAsia, the two Southeast Asian companies are again negotiating a merger and aiming for a 2025 deadline for the deal.

Grab Holdings (GRAB) shares jumped over 13% on Tuesday, fueled by reports of a potential merger with rival GoTo Group and an HSBC rating upgrade.

According to a report by DealStreetAsia, the two Southeast Asian companies are again negotiating a merger and aiming for a 2025 deadline for the deal.

Bloomberg reported that the companies are discussing a scenario valuing Indonesia’s GoTo at more than 100 rupiah apiece.

Bloomberg, however, also stated that the current talks may not lead to a deal at all.

According to earlier reports, the two companies, both backed by Softbank, had discussed a potential deal, but nothing materialized.

According to TheFly, Citi analysts wrote that the combined companies would control and cover between 80% and 90% of on-demand services in Indonesia and have a more considerable share of digital wallets and financial services.

The brokerage noted that if the companies were merged, there would be expected savings on aggressive user subsidies and positive margin upside, a more rapid pace of new user acquisition with broader product offerings, and lower-tier cities penetration, among other benefits.

Separately, HSBC upgraded the stock to “Buy” from “Hold” but reduced the price target to $5.45 from $5.50.

The analyst noted that the stock's valuation has become attractive after a recent price correction, according to TheFly.

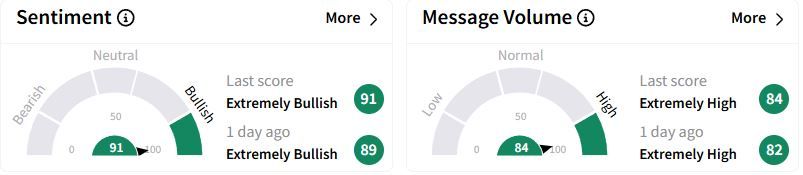

Retail sentiment on Stocktwits climbed further into the ‘extremely bullish’ (91/100) territory, while retail chatter was ‘extremely high.’

One user, however, raised doubts over the potential merger blaming Singapore’s antitrust laws.

Over the past year, Grab stock has gained nearly 63%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<