According to Coinglass data, Ethereum witnessed $253.8 million in liquidations in the last 24 hours, of which $205 million came from long positions.

Ethereum (ETH) was among the hardest-hit cryptocurrencies in the past 24 hours as Bitcoin (BTC) briefly plunged to an intraday low of around $76,800.

While Bitcoin rebounded above $81,630 in U.S. morning trade on Tuesday, Ethereum remained under pressure, failing to reclaim the psychologically significant $2,000 level, according to CoinGecko data.

The second-largest cryptocurrency by market capitalization fell more than 11% for the day, making it the biggest loser among the top 20 major cryptocurrencies.

It hit an intraday low of $1,791 before stabilizing at around $1,900 – marking a 61.5% decline from its all-time high of over $4,800 seen in November 2021.

According to Coinglass data, the crypto market saw more than $910 million in liquidations over the past 24 hours, with Bitcoin and Ethereum accounting for nearly equal portions.

Bitcoin traders suffered $293 million in liquidations, while Ethereum liquidations totaled $253.8 million – of which $205 million came from long positions, signaling a sharp unwinding of bullish bets.

The sell-off comes as broader financial markets remain volatile amid ongoing concerns about inflation and global trade tensions.

Ethereum also saw one of its largest weekly exchange net outflows in over a year as investors pulled funds amid its slide below the $2,000 psychological threshold.

Crypto exchanges recorded a net outflow of approximately $1.8 billion from ETH last week, marking the highest weekly withdrawal since December 2022, according to data from IntoTheBlock.

On the institutional side, Ethereum ETFs mirrored the trend, with net outflows of $89.2 million last week, according to CoinShares’ latest report.

Investors are closely watching for key inflation data expected Wednesday, along with the implementation of new steel and aluminum tariffs that could further weigh on market sentiment.

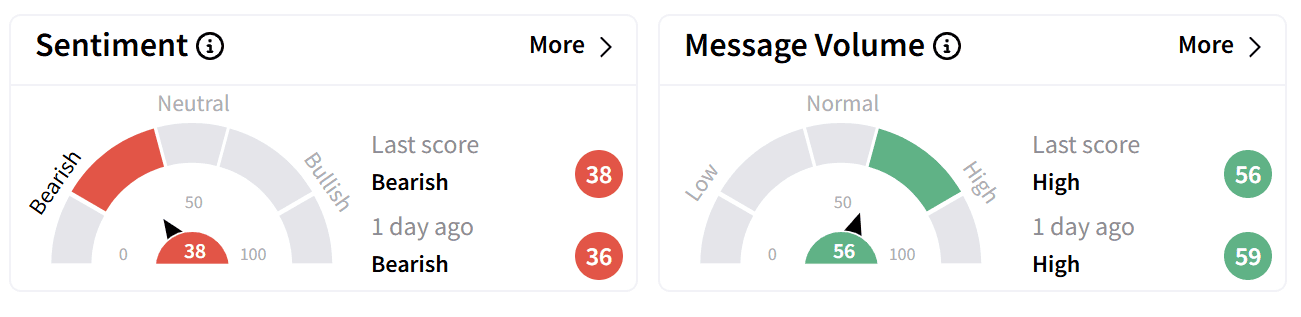

On Stocktwits, retail sentiment around Ethereum edged higher but remained in ‘bearish’ territory.

One user speculated that ETH's price could drop to $1,300 by month-end, while another described the current price action as a “slow bleed.”

Ethereum is down more than 10% over the past week and has lost more than half its value in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: IBM’s Legal Momentum Continues With Supreme Court Victory Over BMC, But Retail Sentiment Is Cooling