Despite a sharp rally driven by solid Q1 earnings, analysts urge caution regarding the profitability and sustainability of scaling.

Shares of Eternal hit fresh record highs after surging over 14% in early trading on Tuesday. The stock had already rallied 7% on Monday, after the parent company of Zomato reported better-than-expected June quarter earnings.

At the time of writing, Eternal’s stock had shed some of the early gains to trade 10.1% higher at ₹299.20.

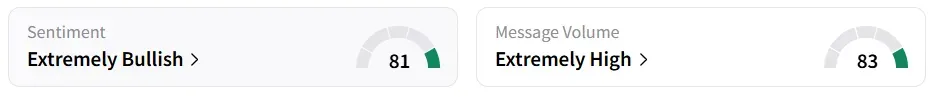

Retail was jubilant on Stocktwits, with sentiment turning ‘extremely bullish’ amid ‘extremely high’ message volumes. It was ‘bearish’ ahead of the quarterly results. Eternal was also the top trending stock on the platform.

What’s Worked For Eternal?

Eternal posted a 70% revenue growth in Q1 FY26 to ₹7,167 crore, even as net profit declined 90% to ₹25 crore, as the company ramped up investments in Blinkit. For the first time, Eternal’s quick commerce arm, Blinkit, surpassed the net order value (NOV) of its food delivery unit, Zomato. Blinkit added 243 stores during the quarter.

Despite weak profit, investor optimism remains high due to Eternal’s aggressive push into quick commerce and long-term growth strategy, noted SEBI-registered analyst Mayank Singh Chandel.

India’s e-commerce market is projected to reach ₹2.12 trillion by 2030, and Blinkit could command a 63% share by FY27. Eternal is also expanding into B2B supply, live events, and intercity food delivery while using AI to boost efficiency. Chandel flagged that Eternal is aiming for 30% annual growth in its food delivery business, even as it looks to transition into a diversified quick commerce ecosystem.

According to SEBI RA Rajneesh Sharma, their quick commerce remained a bright spot, with 127% NOV growth (YoY), overtaking traditional food delivery. Both Hyperpure and Going-out segments showed robust growth of 89% and 30%+ respectively. Additionally, the cash reserves of ₹18,857 crore provide a solid financial cushion for future investments.

Eternal Q1: The Concerns

Despite its strong revenue growth, Eternal’s adjusted EBITDA dropped 42% YoY, signaling profitability challenges amid rapid scaling. The quick commerce vertical also reported an adjusted EBITDA loss of ₹182 crore (-1.8% of NOV), indicating high operational costs. Hyperpure’s expected decline in the upcoming quarters raises concerns about its sustainability.

The management has acknowledged EBITDA pressures resulting from aggressive store expansion but remains confident in its long-term profitability.

Sharma observed that while its shift toward quick commerce signals a bold diversification strategy, profitability lags. And food delivery’s slower growth suggests maturing demand, as well as the need for new catalysts to accelerate growth.

Eternal Stock: What Next?

From February 2023 to September 2024, the stock surged from ₹50 to ₹300 and has since moved sideways between ₹200 - ₹300. A sustained breakout above ₹300 or improved profitability in the coming quarters could trigger a new rally, he added. For now, Chandel rates the stock as ‘hold’, driven by the company’s ambitious plans and strong revenue growth.

For traders who are invested, he recommends holding Eternal. But for those looking to enter the stock, Chandel advised waiting for a breakout above ₹300 or improvement in profit numbers over the next few quarters. He emphasized that Eternal is building an ecosystem beyond a food delivery app, but it continues to spend more than it generates.

Meanwhile, Sharma highlighted that Eternal has broken out of a descending trendline, forming a bullish Marubozu-like candle with strong volumes, suggesting renewed buying interest.

The short-term structure shows an ascending triangle with higher lows, while the long-term uptrend remains intact. He identified key resistance at ₹289.45 and ₹305.50, with support at ₹242.15 and ₹223.70.

Fundamentally, the company is financially well-positioned to absorb short-term pressure as it doubles down on long-term growth, he added. A bullish case is supported by a breakout and a higher low base; the bearish case hinges on resistance at ₹289.45 and a potential pullback to ₹242.15, according to Sharma.

Brokerages Bullish

Brokerages also rated the results highly, with Bernstein maintaining an ‘Outperform’ rating while raising the target price to ₹320 from ₹280. It noted a strong Q1 led by dark store expansion, lower adjusted EBITDA losses, and leadership in India’s quick commerce space.

Citi kept its ‘Buy’ rating on the stock and raised the target price to ₹320 from ₹290, citing strong momentum and a positive surprise on quick commerce EBITDA.

Goldman Sachs maintained its ‘buy’ rating and increased the target price to ₹340.

However, Macquarie retained an ‘Underperform’ rating with a target of ₹150, citing caution due to unproven unit economics and steep valuations for Blinkit.

Year-to-date, the stock has surged nearly 40%.

For updates and corrections, email newsroom[at]stocktwits[dot]com<