Ahead of Q1 results, stock trades near key support. It is expected to report a growth in topline and profit figures for the first quarter of fiscal 2026, according to reports.

Indian pharmaceutical giant Dr. Reddy’s Laboratories is expected to report a growth in topline and profit figures for the first quarter of fiscal 2026.

Ahead of its results on Wednesday, the Dr. Reddy’s shares were down 1.3% at ₹1,239.90.

Fundamentally, the company has maintained solid financials, driven by its U.S. generics business, improved margins, low debt, and consistent free cash flow in FY24. It is backed by high R&D investment and strategic expansion, and continues to focus on innovation and complex generics.

With global pharma tailwinds and a healthy balance sheet, all eyes will be on management commentary and forward guidance tomorrow.

Technical Analysis

The stock has been consolidating after a correction from its all-time high of ₹1,411, as observed by SEBI-registered analyst Rohit Mehta.

Support lies between ₹1,140 and ₹1,170. If the stock is able to hold above this range, it could rebound towards ₹1,300, Mehta said. A breakdown, however, could push the stock toward ₹1,020 - ₹1,050.

SEBI RA Deepak Pal noted consolidation around the ₹1,250 - ₹1,260 zone, which is near key moving averages, including the 55-day exponential moving average (EMA) and the 50-day simple moving average (SMA), indicating a critical support region. The relative strength index (RSI) is at 42.63, placing the stock in a neutral to mildly oversold zone.

Moving average convergence/divergence (MACD) remains in bearish territory with no confirmed crossover, hinting at weak momentum, Pal said. Parabolic SAR dots above the price reinforce the short-term downward bias.

The analyst sees key support between ₹1,230 and ₹1,240 with resistance around the ₹1,280 - ₹1,300 range. Any breakout above this zone could lead to a rally toward ₹1,340 - ₹1,360. Pre-result dips may offer a low-risk entry, Pal added.

According to Vijay Kumar Gupta, another SEBI RA, Dr. Reddy’s Laboratories is currently trading just above the Ichimoku cloud, a key support zone. Momentum indicators like the Commodity Channel Index (CCI) and Trailing Twelve Months (TTM) Squeeze reflect a slowdown, while the Chaikin Money Flow (CMF) shows mild distribution, hinting at cautious sentiment.

However, as long as the ₹1,230 support level holds, the potential for a reversal remains intact, especially if there’s a sector-wide trigger from the pharma space.

A potential near-term upside can be seen between ₹1,275 and ₹1,294, with ₹1,215 as a closing-basis stop-loss, he added. The stock may continue to consolidate in the coming sessions, but the medium-term trend stays bullish unless the key support is breached.

The setup offers a low-risk, high-reward opportunity for patient investors, he said.

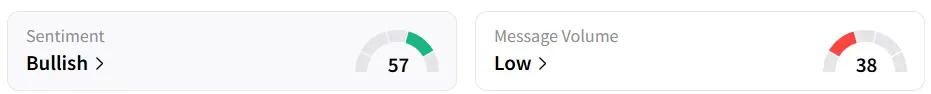

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day earlier.

YTD, the stock has lost 10.6%.

For updates and corrections, email newsroom[at]stocktwits[dot]com<