Retail sentiment on the stock improved from ‘bullish’ to ‘extremely bullish’

Shares of Designer Brands Inc. ($DBI) rose nearly 5% on Tuesday afternoon after having dropped nearly 19% after the Hush Puppies parent posted disappointing third-quarter earnings, but retail sentiment stayed strong.

The footwear and accessories maker’s earnings per share stood at $0.27, missing the consensus estimates of $0.35. While revenues came in at $777.19, below the expected $802.14 million quoted by Wall Street analysts.

"The third quarter started strong, driven by back-to-school season and the success of our athletic and athleisure offerings, bolstering our confidence that we had reached a turning point in our business,” Doug Howe, CEO, said in a statement.

However, the company had a “difficult transition” into the fall season with unseasonably warm weather and ongoing macroeconomic uncertainty that has placed pressure on consumer discretionary spending, specifically in the company’s seasonal category, he added.

“As a result, we saw our total company comparable sales decline 3.1% for the quarter,” Howe said.

The company updated its outlook for 2024: It expects EPS to fall between $0.10 - $0.30 compared to its earlier forecast of $0.50 - $0.60.

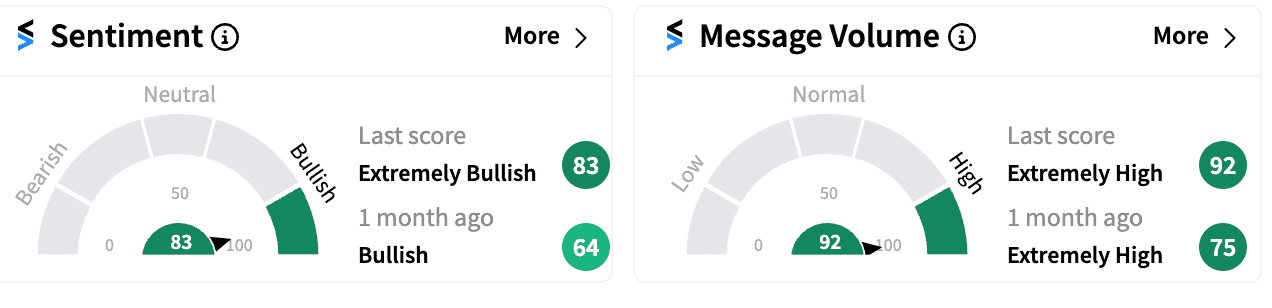

Retail sentiment on the stock improved from ‘bullish’ (64/100) to ‘extremely bullish’ (83/100) from a month ago. Message volumes have continued to be in the ‘extremely high’ zone.

DBI sentiment meter and message volumes on Dec 10

The company also said it will pay a dividend of $0.05 per share for both Class A and Class B common shares, payable on December 20 to shareholders of record at the close of business on December 6.

Designer Brands is the maker of well known footwear brands and accessories including Crown Vintage, Hush Puppies, Jessica Simpson, Lucky Brand, Topo Athletic, and Vince Camuto.

Designer Brands stock is down 32% year-to-date.