Delhivery stock soared post-earnings, but analysts are divided.

Delhivery shares jumped 12% on Monday after the logistics tech company posted its first-ever full-year net profit for FY25 — a milestone that signals a key turnaround in its business trajectory.

The company reported a consolidated March quarter profit of ₹72.6 crore, primarily driven by 24% YoY revenue growth in its part-truckload (PTL) segment.

This performance was further buoyed by strategic initiatives, including the ₹1,400 crore acquisition of Ecom Express, which is set to boost market presence and operational scale.

Delhivery is also entering the rapid commerce segment, indicating plans to diversify and strengthen its offerings.

SEBI-registered analyst Aditya Hujband believes that while momentum is strong, caution is warranted due to valuation concerns. He sees resistance at ₹400 and support in the ₹310–₹320 range, pointing to a tight trading band for now.

Delhivery’s valuation multiples remain elevated, with a price-to-earnings (PE) ratio of 164. The return on equity (ROE) is modest at 2.72%, and the price/earnings-to-growth (PEG) ratio stands at 7.98, signaling potential overvaluation relative to growth prospects.

He also flags the decline in promoter holding from 55% in September 2024 to 52% in May 2025 as a risk factor.

In contrast, Finversify sees ongoing strength in trend, supported by strong ADX and rising volumes.

They expect the rally to continue until the ₹400–₹410 resistance zone is tested, with ₹310 as a strong technical support.

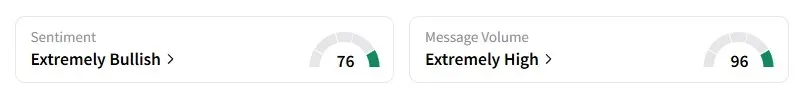

Retail sentiment on Stocktwits has turned 'extremely bullish', with message activity spiking alongside the share rally.

Delhivery shares gained 4% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<