According to the firm, fears of Hoka growth slowing down are overblown.

Shares of Deckers Brands ($DECK) were in the spotlight on Friday as the company received an upgrade from Citi, with retail sentiment staying strong.

Citi upgraded Deckers Outdoor to ‘Buy’ from ‘Neutral’ with an unchanged price target of $215, reported Fly.com. The report cited the firm saying fears of Hoka growth slowing down are overblown and Decker’s recent selloff in its shares following its Q3 print is unwarranted. Slower sales in Hoka's wholesale business next quarter may be a function of selling into fewer wholesale doors compared to last year as well as its sell-in but underlying demand is still strong.

Additionally, two years of "strong" double-digit growth at Ugg, its brand’s market dominance and momentum in the comfort footwear sector makes it likely the brand can grow at least mid-single-digit in fiscal 2026 and beyond, said the report.

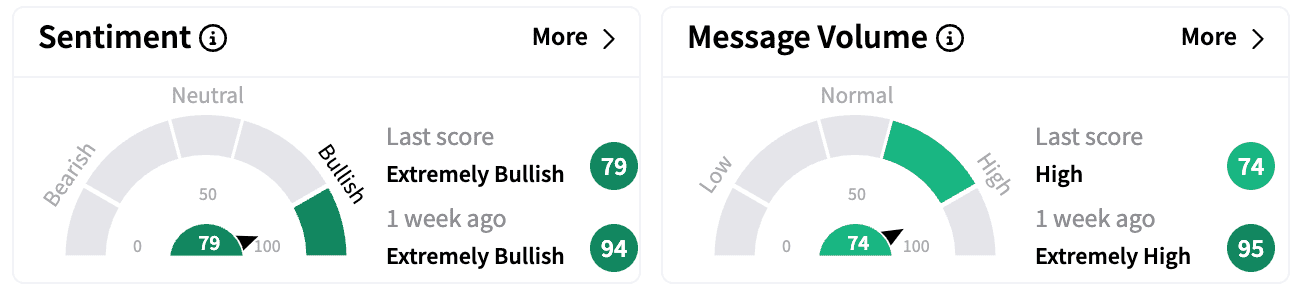

Sentiment on Stocktwits remained ‘extremely bullish.’ Message volumes were in the ‘high’ zone.

Deckers’ net sales increased 17.1% to $1.83 billion compared to $1.60 billion in the year-ago period. That was above $1.73 billion that Wall Street analysts expected. Its earnings per share stood at $3.00 compared with $2.61 quoted by analysts.

Decker’s Hoka brand net sales increased 23.7% to $530.9 million compared to $429.3 million in the same period last year.

For full year 2025, Deckers said its diluted earnings per share is now expected to be in the range of $5.75 to $5.80. While net sales will be about 15% to $4.9 billion; the operating margin is now expected to be about 22%.

Deckers Brands portfolio of brands includes Ugg, Hoka, Teva, Koolaburra, and Ahnu.

Deckers stock is up 9.2% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<