Evercore ISI has assigned an ‘In Line’ rating and a $110 price target to Deckers, which is experiencing a slowdown in its direct-to-consumer channel for Hoka shoes.

Deckers Outdoor Corp. (DECK) was removed from Evercore ISI’s "Tactical Outperform" list on Monday, as the firm believes that overall sentiment into the footwear company’s earnings "skews bearish,” mainly due to softness in the direct-to-consumer channel for Hoka, a big concern for investors.

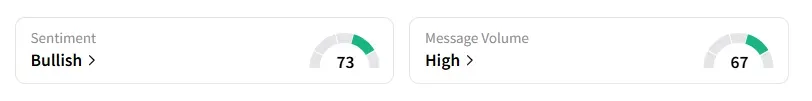

Retail sentiment on the stock dipped to ‘bullish’ from ‘extremely bullish’ with chatter levels at ‘high’, according to Stocktwits data.

Deckers' shares were up 1.2% in premarket trading on Monday and have lost nearly half of their value year to date.

Evercore ISI has an ‘In Line’ rating and $110 price target on Deckers’ stock, according to TheFly.

A bullish user on Stocktwits expressed optimism on the stock ahead of the earnings.

Analysts have noted that Deckers, the maker of Hoka and UGG boots, has experienced significant growth over the last two years, primarily due to gaining market share in the running shoe category, alongside Roger Federer-backed On Holding, which has given tough competition to sportswear giant Nike (NKE).

Wells Fargo analyst Ike Boruchow lowered Deckers’ price target to $90 from $100 on Monday and maintained an ‘Equal Weight’ rating.

Nike's renewed interest in performance running is thwarting Deckers' clearance initiatives on Clifton 9 and Bondi 8, creating longer-than-expected headwinds in the U.S., mainly in the direct-to-consumer channel, Boruchow added.

Deckers is expected to post earnings on July 24. Its first-quarter net sales are estimated to be $900.4 million, and earnings per share are expected to be $0.68, according to data compiled by Fiscal AI.

Deckers has lost over 30% of its value in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<