Crompton Greaves Consumer Electricals reported a 22.5% rise in Q4 net profit and expanded EBITDA margins to 12.8%, signaling strong operational performance.

Shares of Crompton Greaves Consumer Electricals Ltd. are showing early indicators of a bullish reversal based on their robust Q4 earnings and technical structure improvements, according to SEBI-registered analyst Krishna Pathak.

According to Pathak, the stock has moved above a long-established downward resistance trendline and is creating higher lows on the daily chart.

At the time of writing, Crompton shares were trading at ₹347.65, up ₹20.25 or 6.19% on the day.

The analyst noted that the current trading pattern above the 50-day EMA near ₹340 suggests a positive shift in short-term market sentiment from bearish to bullish.

According to Pathak, the stock found important accumulation points between ₹322 and ₹330 during market dips.

The analyst's price target range extends to ₹423 and then ₹459, followed by ₹494.

Due to the 200-DMA, the stock faces substantial resistance between ₹379 and ₹390, which can trigger selling pressure.

The company's Q4 net profit rose 22.5% year-on-year to settle at ₹169.5 crore while its revenue grew by 5.1% to ₹2,060.6 crore.

EBITDA expanded to ₹264.4 crore, a 30% growth rate following an increase in profit margins from 10.4% to 12.8% year over year.

The stock continued to support between ₹290 and ₹300 while creating a higher low point, which validates its bullish potential.

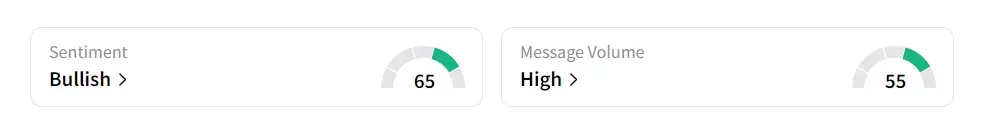

On Stocktwits, retail sentiment was ‘bullish’ amid ‘high’ message volume.

Crompton Greaves shares have declined 7.4% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<