Ahead of earnings, several brokerages upped their price targets for Credo, highlighting that the growing demand for artificial intelligence (AI) applications bodes well for the company.

Shares of Credo Technology Group (CRDO) plunged over 8% in Monday’s regular trade ahead of the company’s third-quarter earnings.

Wall Street expects the company to post earnings per share (EPS) of $0.18, more than quadrupling from $0.04 a year earlier.

As far as the topline is concerned, Credo is expected to report revenue of $120.36 million, more than doubling from $53.1 million in the year-ago period.

Past data shows that Credo has beaten earnings expectations in all the previous four quarters, but missed revenue estimates in one.

Ahead of earnings, several brokerages upped their price targets for Credo, according to The Fly. They highlighted that the growing demand for artificial intelligence (AI) applications bodes well for the company.

Stifel analysts noted that active copper technology continues to grow in importance, and Credo could be a prime beneficiary of demand coming from AI players. The company makes copper cables in its connectivity solutions.

Data from FinChat shows an average price target of $82.33 for Credo, implying an upside of 64% from Monday’s closing price.

Overall, there are 12 brokerage recommendations, of which seven have a ‘Buy’ rating, four have an ‘Outperform’ call, and one says ‘Hold.’

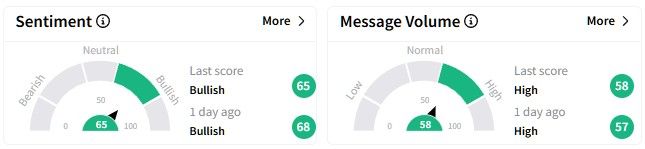

Retail investors on Stocktwits remained ‘bullish’ on Credo’s prospects as they gear up for the company’s Q3 earnings. Message volume picked up, staying at ‘high’ levels.

Credo’s stock has fallen nearly 25% year-to-date, but it has more than doubled over the past year, with gains of 134%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<