Under the deal, BC Partners planned to buy up to $150 million of convertible preferred units, a newly-formed Delaware limited liability company and a wholly-owned subsidiary of the company.

ContextLogic Inc. shares have gained nearly 9% in the past week, driven by a strategic deal from an international investment firm, and were seeing a spike in retail interest ahead of the release of quarterly earnings on Monday.

The company is expected to report earnings per share of $0.04 for the fourth quarter.

Last week, ContextLogic announced an investment from BC Partners, an alternative investment manager with 40 billion euros ($41.5 billion) in assets under management.

Under the deal, BC Partners planned to buy up to $150 million of convertible preferred units of ContextLogic Holdings, a newly-formed Delaware limited liability company and a wholly-owned subsidiary of the company.

The preferred units will have an initial dividend rate of 4%, which will increase to 8% upon the closing of an acquisition, said the company.

According to the company, the investment led by BC Partners' credit arm provides ContextLogic with access to up to $300 million of cash and $2.7 billion of cumulative net operating losses.

BC Partners and ContextLogic will "together review, identify, and evaluate strategic opportunities for the benefit of ContextLogic and its stockholders," the company added.

"We strongly believe this new investment will provide us with the capital and flexibility needed to complete an attractive acquisition that could serve as a platform for future acquisitions and enable ContextLogic to fully utilize its considerable assets," said Rishi Bajaj, CEO of ContextLogic.

One retail trader believes the upcoming earnings report is "going to be [the] best one ever" and found it "interesting" that the company announced the strategic investment ahead of it.

Sentiment on Stocktwits improved to 'extremely bullish' from 'bearish' in the past week, while message volume rose to 'extremely high' from 'low.'

As of Sept. 30, ContextLogic had $33 million in cash and cash equivalents, $117 million in marketable securities, and $8 million in prepaid expenses and other current assets.

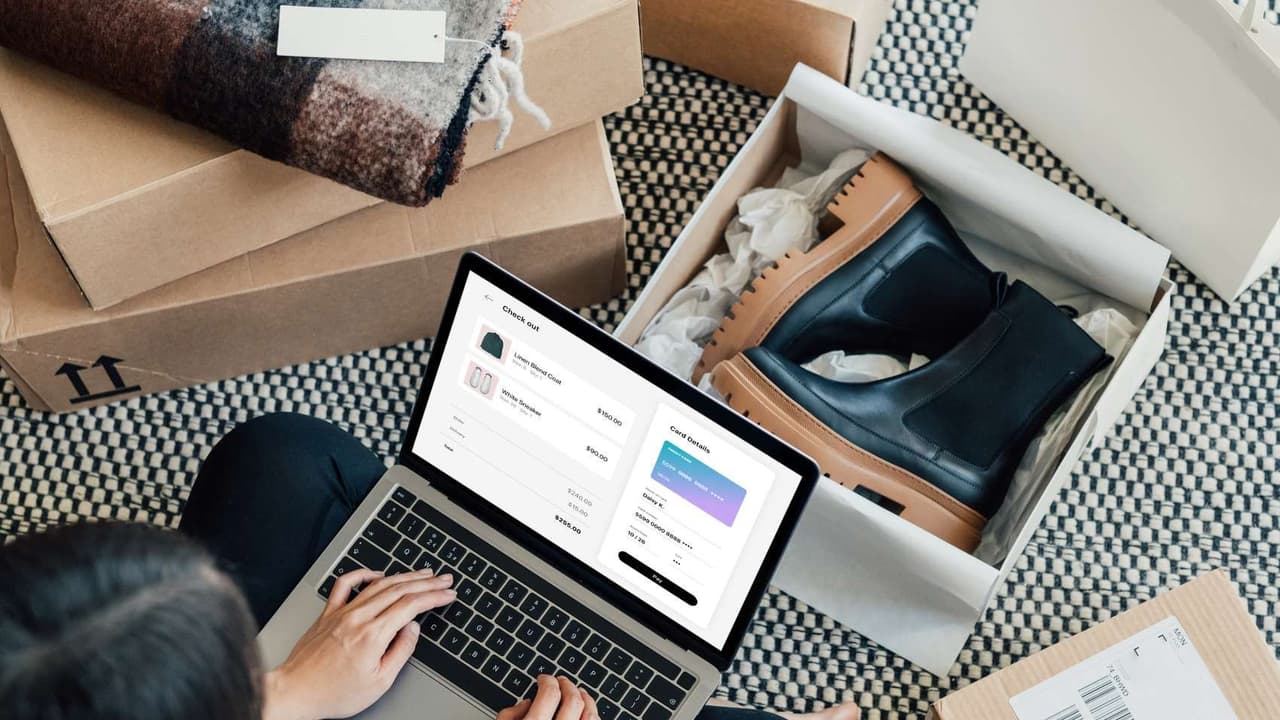

ContextLogic, which sold its operating assets and liabilities in April 2024, is focused on acquiring and building operating businesses.

The company formerly operated the Wish e-commerce platform, which it sold to Qoo10, an e-commerce platform operating localized online marketplaces in Asia, for approximately $173 million in cash.

ContextLogic stock is up 16.5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

1EUR= $1.03<