The company also said growing power demand provides logic to its $16.4 billion acquisition of Calpine Energy.

Constellation Energy (CEG) stock extended gains in after-hours trading on Tuesday after rising more than 10% in the regular session on optimism around long-term power supply deals.

The company said it was nearing long-term agreements with customers and added that the growing power demand provides logic to its $16.4 billion acquisition of Calpine Energy.

According to Energy Information Administration data, U.S. power consumption would continue to hit fresh records in 2025 and 2026.

Much of the growth is attributable to data centers as tech giants such as Microsoft and Google pledge billions of dollars to set up new data centers.

U.S. President Donald Trump’s administration has also repeated its calls to win the “AI race”. It has been supportive of nuclear power, which is viewed as a reliable source of clean energy.

“As a number of the data center companies have noted in their plans, relicensing nuclear plants is incremental. We've seen that in policy space,” CEO Joseph Dominguez said.

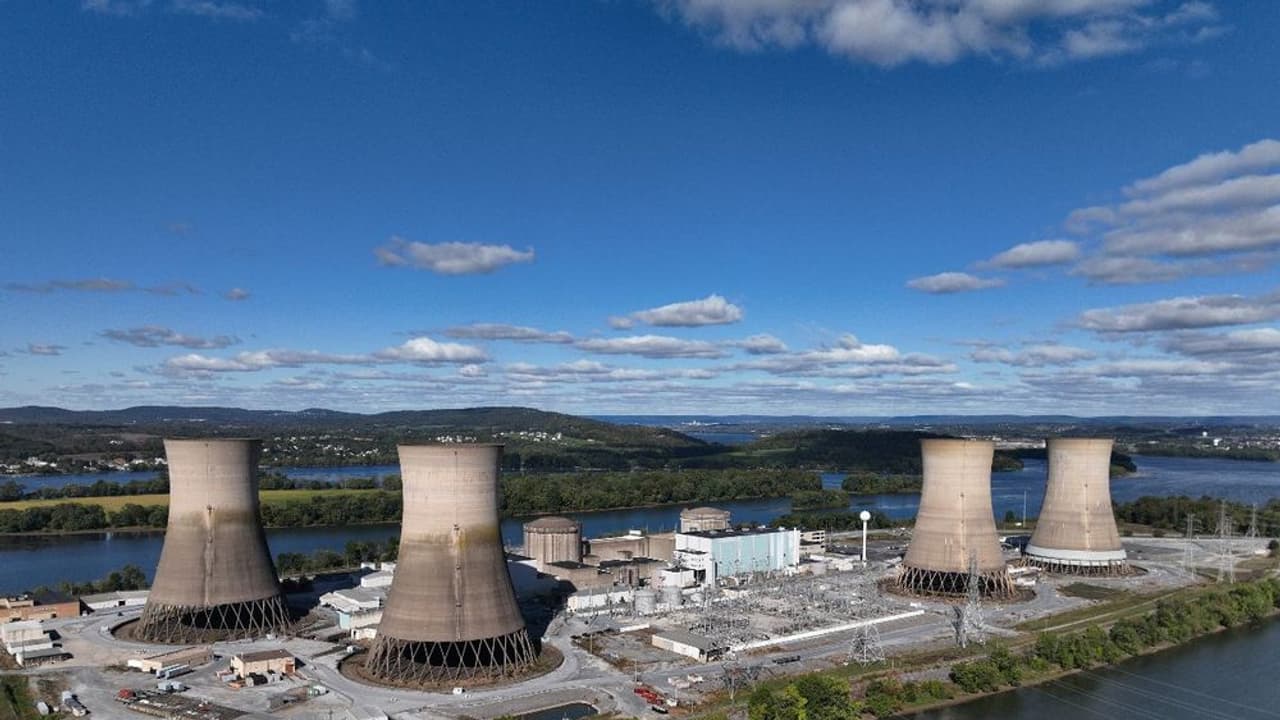

Constellation, the largest producer of nuclear energy in the U.S., had agreed to open the Three Mile Island nuclear power plant to supply electricity to Microsoft’s data centers.

The company posted first-quarter adjusted earnings of $2.14 per share, which missed estimates of $2.22 per share, according to Koyfin data.

The Baltimore-based company reaffirmed its 2025 operating earnings forecast between $8.90 per share and $9.60 per share.

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (83/100) territory, while retail chatter was ‘extremely high.’

Some users also cited a report about a potential executive order related to hastening nuclear energy deployment as a positive development.

Constellation Energy stock has gained nearly 21% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<