Retail traders believe that the completion of the William Minerals acquisition could soon follow the share consolidation announcement.

Shares of China Natural Resources (CHNR) spiked 41% higher to $0.79 after market hours on Tuesday.

The mining company announced the effective date of its share consolidation, under which every eight issued and outstanding common shares will be merged into one common share.

Effective at market open on June 13, 2025, the company’s common shares will begin trading post-combination, with the share combination intended to increase the per-share trading price.

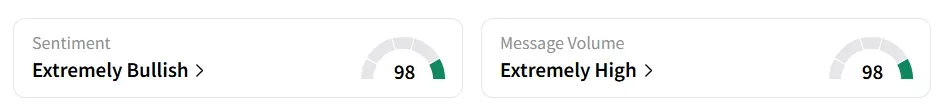

Retail sentiment on Stocktwits turned ‘extremely bullish’ versus ‘neutral’ a week ago, while message volume was ‘extremely high’.

China Natural Resources is looking to finalize a $1.75 billion deal to acquire Williams Minerals, a lithium mining firm in Zimbabwe. The agreement was first announced in 2023.

One bullish user said that the share combination could be a precursor to the completion of the Williams Minerals deal.

Another user believes that the recent developments, supported by bullish technical charts, suggest strong potential for the stock.

According to one user, if the stock breaches $0.85, it can climb to $1.30-$1.40.

Shares of the company have declined 17.6% year-to-date through Tuesday, when the stock closed down 5.4% at $0.56.

For updates and corrections, email newsroom[at]stocktwits[dot]com<