On an adjusted basis, the company reported earnings of $2.06 per share for the fourth quarter, compared with the average analysts’ estimate of $2.11 per share.

Chevron’s (CVX) shares fell 1.8% in pre-market trade on Friday after the oil major’s fourth-quarter earnings missed Wall Street estimates, with its downstream unit posting a loss for the first time since the pandemic.

According to FinChat data, the company reported adjusted earnings of $2.06 per share for the fourth quarter, compared with the average analysts’ estimate of $2.11 per share.

Its downstream or refining unit reported a loss of $248 million during the quarter, compared to a profit of $1.15 billion last year. Lower prices and a 3% decline in U.S. sales volumes hurt the company.

Refining margins had declined last year due to a rise in global production capacity and lackluster demand in major economies.

However, its oil and gas production unit reported a profit of $1.42 billion, compared to a year-ago loss of $1.35 billion when it factored in impairment charges for the assets in California.

Fourth-quarter production in the U.S. rose to a quarterly record of 1.65 million barrels of oil per day (boe/d), aided by strong output from the largest U.S. shale oilfield, the Permian Basin. Chevron aims to produce one million barrels from the Permian basin by 2025.

“We expect to add $10 billion of annual free cash flow over the next two years, led by growth in advantaged Upstream assets,” CEO Mike Wirth said in prepared remarks.

The Houston-based firm also raised its quarterly dividend by 5% to $1.71 per share.

The company expects a 6% to 8% rise in total production in 2025, excluding asset sales.

Chevron attributed the projected lift in output to ramp-up in the Gulf of Mexico, renamed officially in the U.S. as the Gulf of America, and an expansion project at Kazakhstan’s Tengiz oilfield.

However, the company said its first-quarter downtime impact would reduce oil and gas production by 45,000 boe/d.

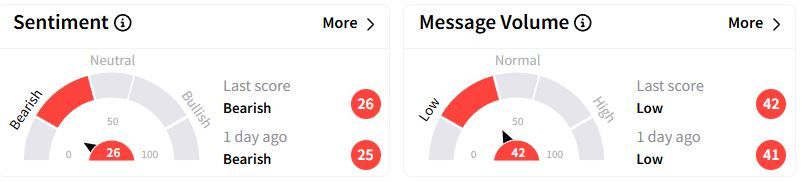

Retail sentiment on Stocktwits remained in the ‘bearish’ (26/100) territory while retail chatter was ‘low.’

Chevron's results contrasted with those of its peer Exxon Mobil, which topped the quarterly profit estimate on Friday. Exxon and Chevron are locked in an arbitration related to the latter’s purchase of Hess Corp.

Over the past year, Chevron shares have gained 5.5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<