The brokerage also raised the stock’s price target to $66 from $45.

Celanese (CE) stock rose nearly 3% on Monday after Wells Fargo upgraded it to ‘Overweight’ from ‘Equal Weight’, according to TheFly.

The brokerage also raised the stock’s price target to $66 from $45. The target implied a 20.8% upside compared to Friday’s closing price.

According to FinChat data, the stock has a consensus price target of $60.65.

Wells Fargo reportedly saw the potential for an uptick in earnings sequentially, aided by improved cost savings and reduced maintenance. However, the analyst noted that the outlook assumes no improvement in demand in the near term.

The brokerage also noted that the stock is trading at a 70% lower valuation than a year ago. Weak industrial demand for Celanese’s products and supply chain issues have weighed on the company’s share performance.

The company is a leading producer of acetyl products, which are utilized in the manufacturing of various chemicals, as well as other engineered materials used in the automotive, consumer electronics, and medical device industries.

Celanese and its peers are aggressively cutting costs as demand growth remains uncertain. In May, the company topped first-quarter earnings expectations.

The cloud of tariff uncertainty also hangs over the industry, prompting Celanese to raise prices for its engineered materials segment. It is also looking to divest its Micromax product portfolio.

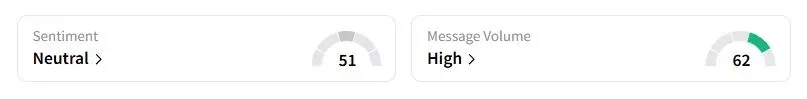

Retail sentiment on Stocktwits was in the ‘neutral’ (51/100) territory, while retail chatter was ‘high.’

Celanese stock has fallen 19.1% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<