The company now expects adjusted earnings per share of $8.15 to $8.20, up from its previous guidance of $8.05 to $8.15.

Cardinal Health (CAH) on Thursday raised its fiscal year 2025 profit guidance on the back of increased profit growth expectations from its pharmaceutical and specialty solutions distribution segment. Shares of the company inched higher toward its record high levels.

The company now expects adjusted earnings per share of $8.15 to $8.20, up from its previous guidance of $8.05 to $8.15, and exceeding an analyst estimate of $8.13, as per Finchat data.

It now anticipates profit growth from the Pharmaceutical and Specialty Solutions segment of between 12% and 13% in the year, up from its prior estimate of 11.5% to 12.5% growth.

The company also expects its ‘Other’ segment to clock a profit growth of between 19% to 21%, up from its old guidance of 16% to 18% growth.

However, the firm now expects profit in the Global Medical Products and Distribution segment to be only about $130 million, down from the previous estimate of $130 million to $140 million.

The company also issued a preliminary forecast for fiscal 2026, including adjusted and diluted earnings of $9.10 to $9.30 per share, in line with an analyst estimate of $9.13 per share.

In the long term, Cardinal expects adjusted and diluted EPS compound annual growth rate of 12% to 14% for FY26 to FY28 and at least $10 billion in total adjusted free cash flow over the next three years.

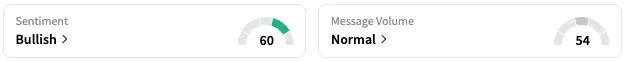

On Stocktwits, retail sentiment around Cardinal Health rose from ‘neutral’ to bullish’ over the past 24 hours while message volume remained at ‘normal’ levels.

According to data from Koyfin, 12 of 17 analysts covering Cardinal Health stock rate it ‘Buy’ or higher, while four rate it a ‘Hold’ and one rates it a ‘Strong Sell’.

The stock has an average price target of $161.61.

CAH stock is up by about 33% this year and by about 59% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<