The analyst noted that as long as the stock finds support above its 100-day moving average, the broader trend is expected to remain bullish

NMDC shares are creeping up to their 200-day moving average at ₹70.13, indicating a bullish momentum, said SEBI-registered analyst Anupam Bajpai.

At the time of writing, the stock was up 0.2% at ₹68.05.

The analyst noted that the stock has been holding above its 100-day moving average since June 19. As long as it remains above this level, the broader trend is expected to remain bullish.

The stock’s fundamentals are strong, with good revenue growth and a low debt ratio. In the fourth quarter, revenue rose by 6.6% to ₹7,005 crore, while the debt-to-equity ratio stood at just 0.14, indicating that it is nearly debt-free. NMDC’s current ratio of 2.42 suggests that it has sufficient current assets to cover its short-term liabilities. Promoter holding remains high at 60.8%.

NMDC has also consistently delivered healthy returns on equity, further supported by a dividend yield of 3.56%, which adds to its appeal for income-focused investors. Bajpai said that the company’s cash flow also remains robust.

According to reports, NMDC plans to spend ₹70,000 crore over the next three years to expand operations, install slurry pipelines, and explore 10 minerals, including gold and lithium.

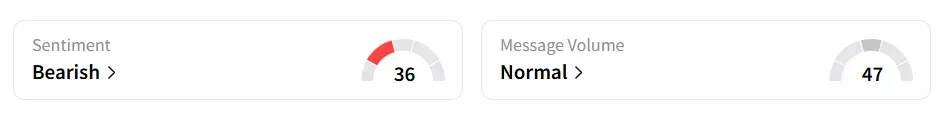

Retail sentiment on Stocktwits continues to remain ‘bearish’.

NMDC’s shares have gained around 3.5% year-to-date (YTD).

NMDC is a PSU involved in the exploration and production of iron ore, as well as diamond mining, sponge iron production, and wind power generation.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<