Tomahawk Ultra delivers ultra-low latency of just 250 nanoseconds and supports data transfer speeds of up to 51.2 Tbps.

Broadcom Inc. (AVGO) on Tuesday launched its newly developed Tomahawk Ultra Ethernet switch, marking a significant advancement in networking solutions tailored for AI systems and high-performance computing.

Designed entirely anew, the switch addresses long-standing issues such as data loss and latency that have plagued Ethernet networks.

Following the announcement, Broadcom's stock traded over 1% higher by mid-morning on Tuesday.

Tomahawk Ultra delivers ultra-low latency of just 250 nanoseconds and supports data transfer speeds of up to 51.2 Tbps. Built to meet the rigorous requirements of interconnected AI clusters and High-Performance Computing (HPC) systems, the switch has hardware-based enhancements that maintain packet accuracy.

Unlike conventional Ethernet switches, which struggle with delays and data loss, Tomahawk Ultra utilizes Link Layer Retry (LLR) and Credit-Based Flow Control (CBFC) to deliver a zero-loss network environment.

These technologies enable instant error recovery and regulate data flow, making the switch suitable for demanding AI workloads and complex scientific modeling.

Tomahawk Ultra is now shipping and is set to be deployed in AI training clusters and large-scale supercomputers globally.

Paired with the Scale-Up Ethernet (SUE) framework, the switch enables end-to-end communication latency of less than 400 nanoseconds. The company has also introduced a trimmed-down version of the SUE specification, SUE-Lite, which is designed for space- and power-constrained environments.

According to a Reuters report, Tomahawk Ultra is capable of connecting up to four times as many chips as Nvidia’s competing switch, making it easier to integrate into existing infrastructure while enhancing communication across AI chip clusters.

Broadcom posted $15 billion in revenue for the second quarter (Q2) 2025, marking a 20% increase year-on-year and slightly exceeding Wall Street’s forecast of $14.97 billion, as per Finchat data.

The growth was fueled by strong demand for its AI chip offerings.

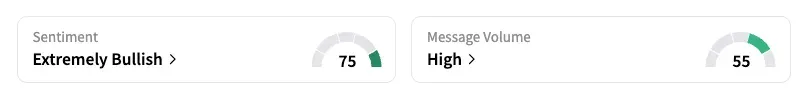

On Stocktwits, retail sentiment around Broadcom improved to ‘extremely bullish’ from ‘bullish’ the previous day.

Broadcom stock has gained over 21% year-to-date and over 63% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<