After a period of consolidation, BHEL could see an upside, supported by strong technical indicators. The analyst believes the stock is well-positioned for long-term growth.

Bharat Heavy Electricals (BHEL) could see a fresh short-term rally if it holds above ₹250 and breaches ₹255, according to SEBI-registered analyst Deepak Pal.

The stock showed strong buying momentum after a period of consolidation between its 14-day and 55-day exponential moving averages (EMAs) over the past week, he noted.

BHEL stock had shed 0.2% in the past week.

The stock appears to be building strength, supported by solid medium- to long-term support near its 55-day EMA at ₹240 and 200-day EMA at ₹233. BHEL is finding support at its 55-day EMA near ₹240 and its 200-day EMA around ₹233, highlighting a strong medium-to-long-term support zone.

In Monday’s session, BHEL opened at ₹248.45, fell to an intraday low of ₹248.40 before closing 1.3% higher at ₹253.3, firmly above its 14-day EMA.

A key resistance lies near ₹255, which could act as a short-term hurdle, Pal said. However, a close above this level could lead to a short-term rally towards ₹265–₹266, potentially retesting the recent high of ₹263.40 on June 10.

According to technical indicators, the moving average convergence/divergence (MACD) remains in positive territory, while the relative strength index (RSI) is hovering around 55, indicating a neutral momentum with room for further upside.

On the downside, immediate support can be seen at ₹250, with a strong support level at ₹240. Structurally, the stock remains positive as long as it stays above key support levels, Pal said.

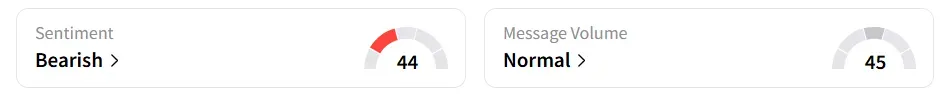

Retail sentiment on Stocktwits remained ‘bearish’.

Year-to-date (YTD), the stock saw a 10.5% growth.

BHEL has strong long-term prospects, driven by India’s growing energy and infrastructure demands. It has strong fundamentals, trading at a P/E of 32–35x with an EPS between ₹4.80 and ₹5.20, and maintains a nearly debt-free balance sheet.

BHEL posted an 89% increase in FY25 net profit. It offers a dividend yield between 1.2% and 1.5% and a return on equity (ROE) of 9% to 11%. The company has a promoter holding of 63.17%, supported by the Government of India.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<