Despite a 4% drop in early trade on Friday, the stock has formed a bullish base on its weekly chart. The analyst pegs ₹2,150 as resistance to watch.

Bajaj Finserv is scheduled to report its quarterly earnings later in the day. According to reports, the financier is likely to report a net profit of ₹2,463 crore and total revenue of ₹34,570 crore for the first quarter of fiscal 2026.

Bajaj Finserv shares were down 4.1% at ₹1,949 in early trade on Friday.

From a technical standpoint, the stock has decisively broken out above a long-standing resistance zone near ₹1,820 - ₹1,850, signaling renewed bullish momentum, according to SEBI-registered analyst Rohit Mehta.

On the weekly chart, a cup-shaped recovery pattern has emerged after a prolonged base formation, with the stock now consolidating above the breakout zone, Mehta said. The next resistance level is seen near ₹2,150.

A sustained move above the resistance could lead to further upside. The stock has found strong support near the ₹1,822 - ₹1,847 band, he added.

On the fundamentals side, Bajaj Finserv has a strong long-term track record. It has a 21.4% CAGR in profits over five years, as well as consistent sales growth. However, valuations remain rich at 4.54x book value, with the interest coverage ratio also a concern.

Financially, the company has experienced healthy growth across all key metrics. In the March 2025 quarter, sales rose 14.2%, operating profit increased 16.4%, profit before tax rose 8.6%, and EPS grew by 14%.

The shareholding pattern reveals a shift, with promoters trimming their holdings from 60.64% to 58.81%. However, both FIIs and DIIs increased their stakes, signaling institutional interest.

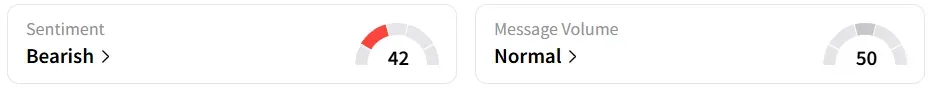

Ahead of the results, retail sentiment on Stocktwits remained ‘bearish’. It was ‘neutral’ a week earlier.

Year-to-date, the stock has gained nearly 30%

For updates and corrections, email newsroom[at]stocktwits[dot]com<