Technical indicators show Axis Bank is testing crucial support zones. Without a confirmed reversal, analysts advise against fresh long positions.

Axis Bank shares fell sharply by around 4.5% on Friday after its June quarter earnings came in below street estimates.

SEBI-registered analyst Mayank Singh Chandel flagged that its performance raised concerns about the bank’s near-term outlook, especially in an environment where even strong private banks are starting to feel pressure. He stated that private banks in India, including Axis Bank, have grown much faster than public sector banks over the past few years, gaining more market share in both deposits and credit.

But now, challenges are emerging. Credit growth is slowing down, profit margins are tightening, a high loan-to-deposit ratio, and higher credit cost, which means increasing default risk. While private banks are still fundamentally strong, they’re now facing short-term headwinds that investors can’t ignore, Chandel observed.

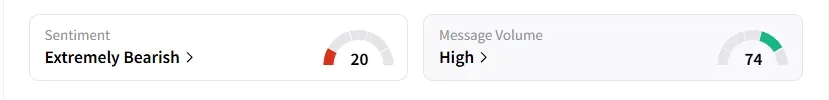

Data on Stocktwits shows that retail sentiment flipped to ‘extremely bearish’ amid ‘high’ message volumes on Friday.

Why did Axis Bank crack?

Analyzing Axis Bank's earnings, he noted that the bank had to set aside ₹3,900 crore as a safety buffer, nearly three times more than in the previous quarter. The bank’s Gross non-performing assets (NPAs) also rose by 10%, and its Net Interest Margin declined. These weak points dented investor confidence and led to a sharp drop in the stock price.

Technical Outlook

From a technical perspective, the stock opened with a sharp gap-down near ₹1,090, below the 200-day Exponential Moving Average (EMA), signaling initial weakness. However, the price quickly recovered to trade around ₹1,109.30 in afternoon trade.

Chandel noted that this recovery came from a support zone at ₹1,083–₹1,071, formed by the upward gap on April 15. As long as the price holds above this zone, the bullish structure remains intact, despite Friday’s volatile start, he added.

Analyst Vijay Kumar Gupta added that the bounce in Axis Bank shares lacks confirmation. Volume is high, but its on-balance volume (OBV) and Chaikin Money Flow (CMF) remain weak. He advised staying away from it unless a reversal is confirmed.

Gupta identified resistance at ₹1,133 (gap fill zone), ₹1,149 (Kijun-sen), and ₹1,166.50 (cloud base); with support at ₹1,075 (gap lower bound), and ₹1,050 (historical structure).

So what should investors do now?

For investors holding the stock, Chandel said that there was no need to panic based on one weak quarter. The bank’s core operating profit grew 14% (YoY), which shows the long-term story may still be strong. For traders who are looking to invest in Axis Bank, he advised a ‘wait and watch’ strategy over the next few quarters to see how the bank handles its rising provisions and cost pressures.

According to Gupta, traders should avoid taking fresh long positions until a close above ₹1,149 with improving volumes. Risk-averse traders may wait for cloud re-entry before entry.

Axis Bank shares have risen 3% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<