Asana’s guidance issued in early December projected a bottom-line loss of $0.01-$0.02 per share and revenue of $187.5 million to $188.50 million.

Enterprise work management platform Asana, Inc. (ASAN) is scheduled to announce its quarterly results after the market closes on Monday.

Wall Street’s consensus estimates call for an adjusted loss per share of $0.01 and revenue of $188.13 million for the fourth quarter of the fiscal year 2025. The top-line estimate suggests year-over-year (YoY) growth of nearly 10%, aligned with third quarter’s growth.

Asana’s guidance issued in early December projected a bottom-line loss of $0.01-$0.02 per share and revenue of $187.5 million to $188.50 million. The company also expected positive free cash flow for the fourth quarter.

In the third quarter, the number of core customers spending $5,000 or more on an annualized basis rose 11% YoY to 23,609. Revenue from these customers climbed 11%. The number of customers spending $100,000 or more was up 18% to 683. Net dollar retention rate was 96%.

Asana stock received a ratings upgrade to ‘Overweight’ in early January from Piper Sandler, with the firm predicting that the company’s stabilization, cost discipline and artificial intelligence (AI) studio product cycle will likely spark a recovery,

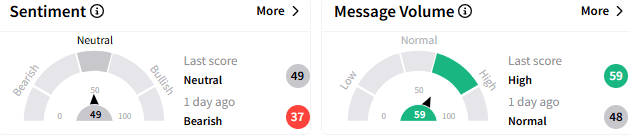

On Stocktwits, sentiment toward Asana stock improved to ‘neutral’ (49/100) from ‘bearish’ a day ago. The message volume also perked to ‘high’ levels.

A bullish watcher positioned for a post-earnings rally, calling the company one of the “easiest earning play money printers.”

Pointing to the strong net dollar retention rate, they said this would ensure earnings and revenue beat even if the company doesn’t acquire new customers.

Another user expressed concerns about insider selling.

Asana’s stock ended Friday’s session up 2.64% to $18.25 and gained an incremental 1.59% in the after hours. However, the stock is down about 10% year-to-date.

For updates and corrections email newsroom[at]stocktwits[dot]com.<