Super Micro stock closed Thursday’s session at the highest level in over two months, adding about 39% so far this year.

Artificial intelligence (AI) server maker Super Micro Computer, Inc.’s (SMCI) stock has seen accelerated upward momentum since early February, even as a key risk event looms ahead.

An ongoing Stocktwits poll and the sentiment meter on the platform underlined retail’s confidence in the company.

The stock's recent up leg started on Feb. 4 when investors reacted to Super Micro’s announcement concerning the full production availability of its AI data center Building Block Solutions, powered by the Nvidia Corp. (NVDA) Blackwell platform.

The upward momentum accelerated after the company scheduled its second-quarter business update. Investors took this as a cue that Super Micro’s new auditor, BDO, hasn’t unearthed any accounting issues.

The much-awaited update wasn't exactly positive. Super Micro’s preliminary second-quarter headline numbers trailed expectations, and it cut its fiscal year 2025 revenue guidance. Notwithstanding the near-term softness relayed by the numbers, investors focused on the company’s rosy 2026 outlook.

It expects 2026 revenue to be $40 billion, with CEO Charles Liang offering upbeat commentary about the uptake of the company’s direct-liquid cooling (DLC) technology.

Concurrently, the company also announced a privately placed $700-million convertible note offering and confirmed that it will regain compliance with Nasdaq's rule regarding the timely filing of financial statements by the Feb. 25 deadline.

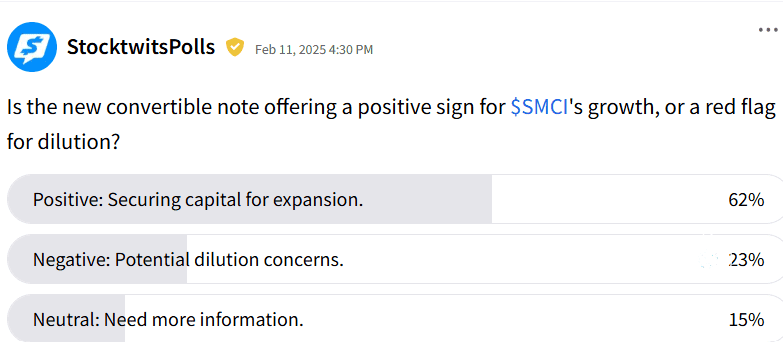

The Stocktwits poll that probed its platform users about their views on the debt offering found that 62% of the 7,000 respondents saw it as a positive sign for Super Micro’s growth. They opined that the debt offering would secure the capital needed for expansion.

Fifteen percent remained neutral, seeking additional information for clarity. The remaining 23% were negative about the offering, potentially due to dilution concerns when the notes are converted.

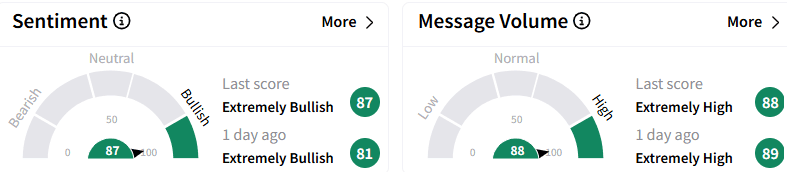

On Stocktwits, sentiment toward Super Micro stock remained ‘extremely bullish’ (87/100) and the message volume stayed ‘extremely high.’

A retail watcher looked forward to the stock finishing the week on a high.

Another user positioned for a five-fold increase in the stock price by the summer.

Super Micro stock ended Thursday’s session by 6.55% at $42.28, marking the highest closing level in over two months. It has added about 39% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <