A Goldman Sachs analyst said he expects the new iPad and Mac products launched this week to help Apple achieve its fiscal second-quarter outlook of low- to mid-single-digit growth.

Apple, Inc. (AAPL) unveiled the latest iteration of its iPad, MacBook Pro and Mac Studio desktop this week, just days after launching its cheaper iPhone 16e model. The new product introductions did not produce any meaningful stock upside amid the broader tech downturn seen since February.

Among the product highlights are:

- Faster new iPad Air with in-house M3 chip, built for Apple Intelligence, armed with a new Magic Keyboard

- Apple Intelligence-ready new MacBook Pro laptop powered by the M4 chip with a cheaper starting price of $999, boasting up to 18 hours of battery life, a new 12MP Center Stage camera

- New Mac Studio powered by M4 Max chip and the newly-launched M3 Ultra, with Thunderbolt 5, up to 512GB of unified memory and up to 16TB solid-state drive (SSD)

Apple said the latest iteration of Mac Studio is the most powerful Mac ever.

The iPad announcement came on Tuesday, while the other two hardware products and the new M3 Ultra chip were launched on Wednesday. Since Tuesday, Apple stock has shed over 1% in three sessions.

Much of the weakness can be traced back to the broader market sell-off triggered by industry-specific and macro concerns. Incidentally, Apple's three-session loss compared favorably to the nearly 2% decline by the broader S&P 500 Index.

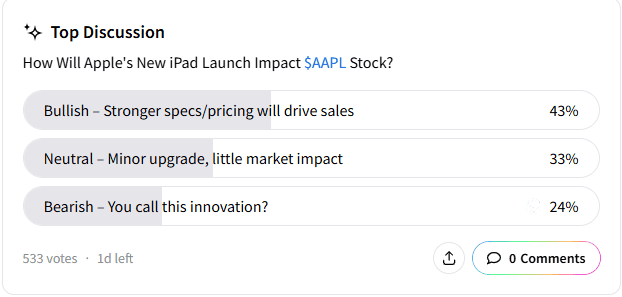

A Stocktwits poll asking users about their views on the likely impact of the product launches on the stock found that 43% remained bullish and expected stronger specifications and pricing to drive sales.

A sizable 34% predicted little market impact, given their view that the upgrades are minor. Another 23% balked at the company’s lack of innovation and adopted a ‘bearish stance.’

The sell-side is optimistic. A Goldman Sachs analyst said the new iPad and Mac products launched this week will likely help Apple achieve its fiscal second-quarter outlook of low- to mid-single-digit growth, TheFly reported, despite the lower starting price of the new MacBook Air.

Goldman has a 'Buy' rating and a $294 price target for Apple stock.

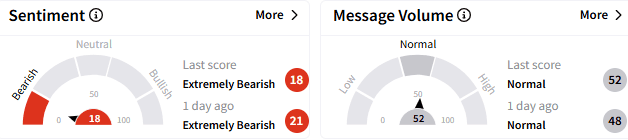

On Stocktwits, sentiment toward Apple stock remained 'extremely bearish' (18/20), with the message volume at 'low' levels.

Apple stock ended Thursday's session down 0.17% at $235.33. The stock is down about 6% year-to-date.

For updates and corrections email newsroom[at]stocktwits[dot]com.<