The analyst said Apar Industries has reclaimed key technical levels after a “death cross” earlier this year, signaling a possible long-term reversal.

Apar Industries has completed a turnaround following a sharp decline earlier this year, and the breakout now underway “is real,”

According to SEBI-registered research analyst Mayank Singh Chandel, the stock staged a V-shaped recovery from its April lows after forming a “death cross” and falling earlier in 2025.

https://stocktwits.com/Ca_mscofficial/message/619375907

Since April 7, a major trendline that has been tested four times is now acting as solid support, he said.

He highlighted a breakout from a symmetrical triangle pattern, calling it a sign that consolidation is over and a fresh upward leg may have started.

The stock is also trading above its 200-day Exponential Moving Average (EMA), supporting a long-term bullish view, he added.

Volume trends further confirm strength behind the move, Chandel said, noting the breakout was not “silent.”

“If this bullish structure holds, the next major move could set new highs,” Chandel said, urging investors to closely watch the trendline and moving averages.

He described the recent move as more than just a pullback, calling it “a recovery with structure, strength, and signals you shouldn’t ignore.”

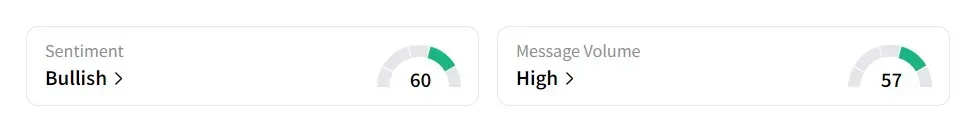

On Stocktwits, retail sentiment was ‘bullish’ amid ‘extremely high’ message volume.

Apar Industries’ stock has declined nearly 16% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<