The analyst said Angel One’s rebound above its 250-day EMA suggests a strong risk-reward bet for short-term traders.

Broking firm Angel One is showing signs of renewed strength after bouncing off its 250-day exponential moving average (EMA).

SEBI-registered analyst Kavita Agrawal noted that the stock has moved decisively above the 250 EMA, which signals resilience in the ongoing trend.

At the time of writing, shares of Angel One were up 1.06% at ₹2,966.2.

Although the move does not mark a fresh breakout, she believes the setup resembles a continuation pattern within a healthy uptrend.

According to Agrawal, the price had previously declined on low volume, a development she described as constructive. It is now rebounding with increasing volume.

She said this could represent the first leg of a new uptrend.

For short-term traders, Agrawal suggested a potential entry around ₹2,950 with a stop loss at ₹2,750 and a target of ₹3,420, offering an approximate risk-reward ratio of 3:1.

She added that Angel One has been part of her long-term investment strategy since it bottomed out, and said the stock has already delivered solid returns for her members.

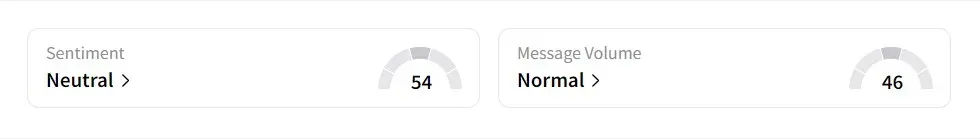

On Stocktwits, retail sentiment was ‘neutral’ amid ‘normal’ message volume.

The stock has declined 1.7% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<