The Finchat-compiled consensus calls for Alphabet to report earnings per share of $2.01 and revenue of $89.15 billion for the first quarter of the fiscal year 2025.

Google-parent Alphabet, Inc. (GOOGL) (GOOG) is scheduled to report its quarterly results Thursday after the market closes. The report will be widely watched, given the company is the first among the mega techs with deep exposure to artificial intelligence (AI) tech to announce its scorecard.

The earnings report comes amid a confounding macroeconomic outlook as President Donald Trump's reciprocal tariffs have roiled the market and reduced visibility into the demand outlook.

Alphabet must also contend with regulatory calls to break up its search business. As recently as last week, a federal court ruled that it willfully acquired and maintained a monopoly in the ad-server and ad exchange markets, although the Sundar Pichai-led company has said it will appeal the ruling.

The Finchat-compiled consensus calls for Alphabet to report earnings per share (EPS) of $2.01 and revenue of $89.15 billion for the first quarter of the fiscal year 2025.

Investors will likely focus on revenue from the company's Google Cloud Platform (GCP) and management commentary on the macroeconomy's impact on advertising revenue.

In a recent note, Morgan Stanley analyst Brian Nowak said larger, performance-based platforms such as Google, Meta Platforms (META) and Amazon are better positioned to offset ad auction bid density weakness.

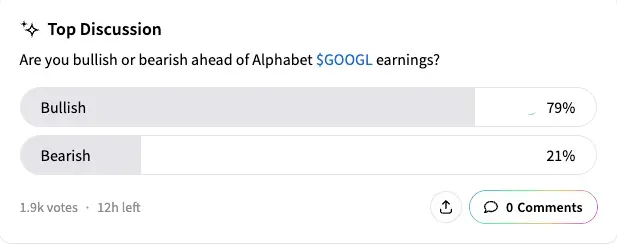

On Stocktwits, retail sentiment toward Alphabet stock turned to 'bullish' (58/100) by late Thursday from 'neutral' a day ago, with the message volume at 'normal' levels.

A bullish watcher pledged their allegiance to the stock, calling it a "long-term" bet.

Another user positioned for a stock move to the $180 level post-earnings.

An ongoing Stocktwits poll that has collected responses from 1,900 users showed that 79% of the respondents were bullish on Alphabet stock ahead of earnings.

Alphabet stock ended Wednesday's session up 2.56% at $155.35, although it is down 18% this year. It has the lowest forward price-earnings (P/E) multiple (17.6) among the "Magnificent Seven" stocks.

The Koyfin-compiled consensus analysts' price target of $202.34 implies Alphabet stock currently trades at a 30% discount.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<