A deteriorating macroeconomic environment is one of the concerns Mizuho analysts have with respect to Accenture’s Q2 performance.

Accenture Plc. (CAN) stock received a price target cut from Mizuho ahead of the company’s second-quarter results, with the brokerage expressing doubt about the company’s ability to outdo its “impressive” Q1 performance.

According to The Fly, analysts at Mizuho lowered the price target for Accenture to $398 from $428, implying an upside of nearly 23% from Wednesday’s closing price. The brokerage maintained its ‘Outperform’ rating for the stock.

A deteriorating macro-economic environment is one of the concerns on Mizuho analysts’ minds with respect to Accenture’s Q2 performance.

The brokerage notes that although Accenture remains a best-in-class operator, the Elon Musk-led Department of Government Efficiency (DOGE) could have an adverse impact on the information technology (IT) budgets of the government – this could have an impact on the toplines of IT companies.

It also added that there is another delay in the inflection point of its proprietary operating expense growth analysis for S&P 500 companies – with a lower ratio considered to be better.

Lastly, the brokerage also underscored a downtick in IT jobs, which could point to a slowdown in the sector.

Accenture is expected to report earnings per share (EPS) of $2.81 in Q2, up from $2.77 in the same period a year earlier. Its revenue is expected to grow to $16.62 billion from $15.8 billion in the year-ago period.

The IT services company has missed revenue expectations in two of the past four quarters, but it missed earnings estimates in only one of these quarters.

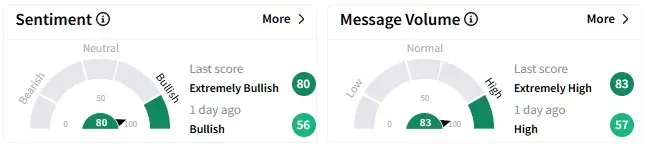

Retail sentiment on Stocktwits around Accenture soared, entering the ‘extremely bullish’ (80/100) territory from ‘bullish’ a day ago.

Message volume soared to ‘extremely high’ levels as investors look forward to the company’s Q2 results.

One user thinks Accenture’s guidance will be “huge” and that there could be a “double digit percentage swing.”

Data from Koyfin shows the average price target for Accenture is $390.92, implying an upside of over 20% from Wednesday’s closing price.

Accenture’s stock has declined nearly 8% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<