The Centre on Monday (July 22) denied the special category status to Bihar. JD(U), a key constituent in the NDA, has recently passed a resolution demanding special category status or a special package for Bihar.

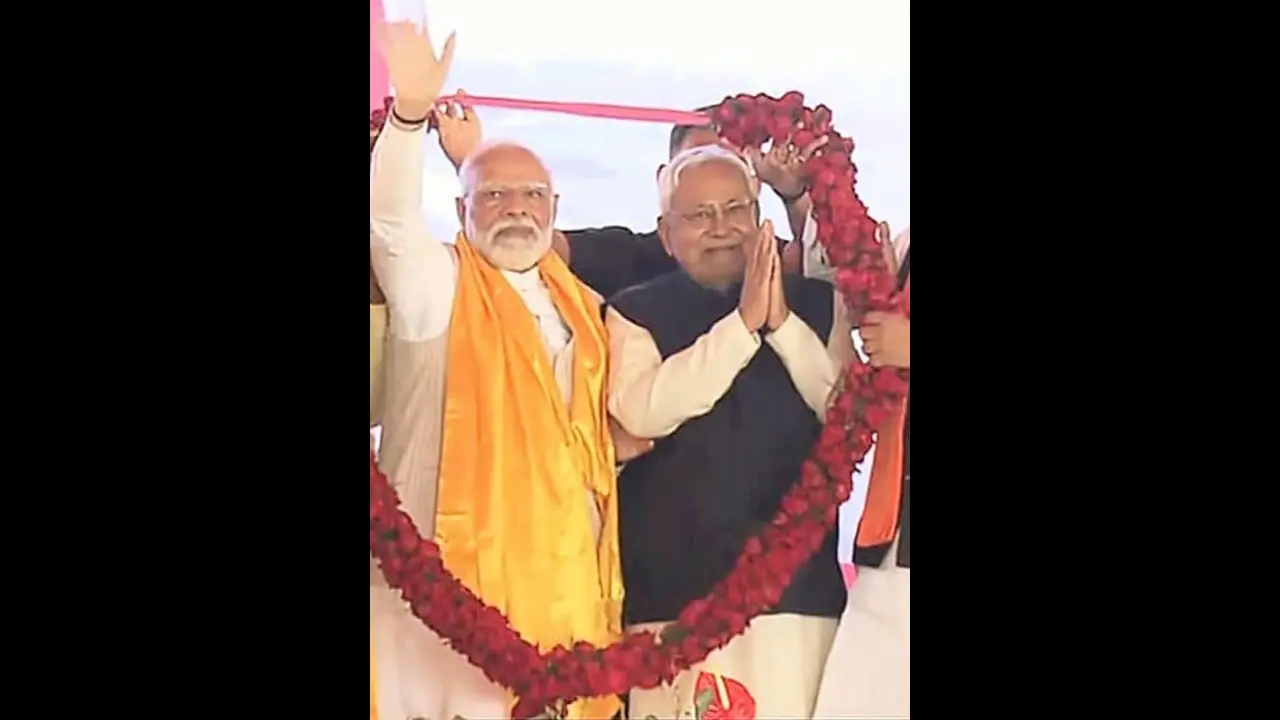

The Centre on Monday reiterated its stand that Bihar will not be granted special category status. The Nitish Kumar-led JD(U), which is a key constituent of the Narendra Modi-led National Democratic Alliance, recently passed a resolution demanding special category status, or a special package, for the state.

As the BJP's key ally in the National Democratic Alliance (NDA), JD (U) demanded a special status category for Bihar, Minister of State for Finance Pankaj Chaudhary, in a written reply, said that special status cannot be granted to Bihar as per the Inter-Ministerial Group (IMG) report.

Chaudhary in a written reply to the question of JDU MP Ramprit Mandal informed Lok Sabha, "The Special Category Status for plan assistance was granted in the past by the National Development Council (NDC) to some States that were characterized by a number of features necessitating special consideration. These features included (i) hilly and difficult terrain, (ii) low population density and/or sizeable share of tribal population, (iii) strategic location along borders with neighbouring countries, (iv) economic and infrastructural backwardness and (v) non-viable nature of State finances. The decision was taken based on an integrated consideration of all the factors listed above and the peculiar situation of the State. Earlier, the request of Bihar for Special Category Status was considered by an Inter-Ministerial Group (IMG) which submitted its Report on 30th March 2012. The IMG came to the finding that based on existing NDC criteria, the case for Special Category Status for Bihar is not made out."

When was this first addressed?

The Special Category Status issue was first addressed in the National Development Council (NDC) meeting in 1969. During this meeting, the D R Gadgil Committee introduced a formula to allocate Central Assistance for state plans in India. Prior to this, there was no specific formula for fund distribution to States, and grants were given on a scheme basis. The Gadgil Formula, approved by the NDC, prioritized special category States such as Assam, Jammu & Kashmir, and Nagaland, ensuring their needs were addressed first from the pool of Central assistance.

Recognizing historical disadvantages faced by certain regions, the 5th Finance Commission introduced the concept of Special Category Status in 1969. This status provided preferential treatment to certain disadvantaged States, including Central assistance and tax breaks. The National Development Council had allocated Central Plan Assistance to these States based on this status.

Until the 2014-2015 fiscal year, the 11 States with Special Category Status benefited from various advantages and incentives. However, following the dissolution of the Planning Commission and the formation of the NITI Aayog in 2014, the recommendations of the 14th Finance Commission were implemented, leading to the discontinuation of Gadgil Formula-based grants. Instead, the devolution from the divisible pool to all States was increased from 32% to 42%.

The 14th Finance Commission, effective from 2015, eliminated the distinction between General Category and Special Category States in the horizontal distribution of shareable taxes. The share of net shareable taxes for States was increased from 32% to 42% for the period 2015-2020. The 15th Finance Commission maintained this rate at 41% for the periods 2020-2021 and 2021-2026, with a 1% adjustment due to the creation of the Union Territory of Jammu & Kashmir. This adjustment aimed to address the resource gap of each state through tax devolution, with Post-Devolution Revenue Deficit Grants provided where tax devolution alone could not cover the assessed gap.

Currently, no additional States are being granted Special Category Status, as the Constitution of India does not provide for such categorization.