JioFinance app, with over 6 million users, offers UPI payments, bill payments, and personalized finance management. The updated app includes 24 digital insurance options and allows users to track spending and view mutual fund assets.

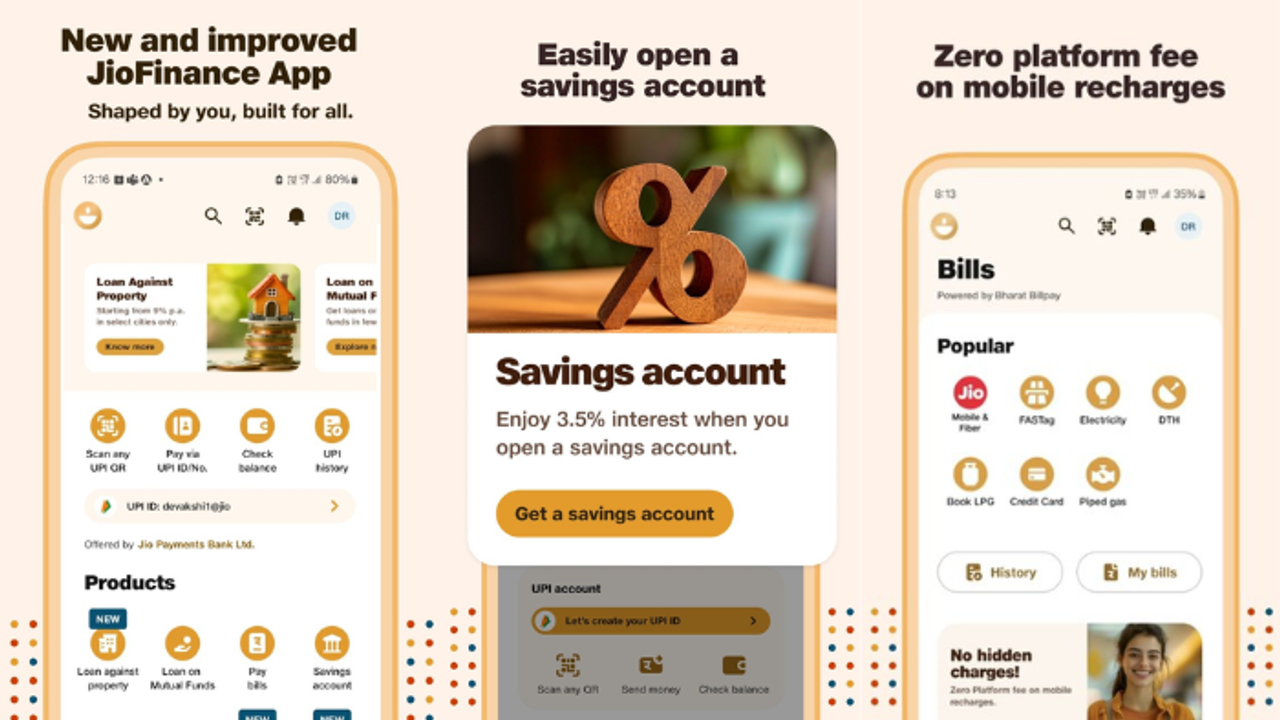

Jio finance Services (JFS), Reliance's finance division, just released an upgraded JioFinance app. The startup claims that it already has over 6 million users after launching a test version of the software on May 30 of this year. JioFinance's Play Store description describes it as a "one-stop app for fast and secure UPI payments, seamless bill payments, and personalized finance management." Additionally, the app allows you to manage your personal spending and view all of your mutual fund assets in one window.

24 digital insurance options, including life, health, two-wheeler, and auto insurance, are available in the app's revised edition. Like Google Pay and PhonePe, it also functions as a UPI payment app, allowing you to begin self-transfer, pay using a cell number, and scan a QR code. Additionally, you can use the app's My Money function to analyze your income and spending and link and access all of your bank accounts and mutual funds in one location.

JioFinance may be used to pay for a variety of expenses, including DTH, electricity, piped gas, credit card bills, FASTag, and cell subscriptions. In only five minutes, JioFinance customers may create digital savings accounts with Jio Payments Bank Ltd. For those who are curious, the bank offers a real debit card and has over 1.5 million users.

If you want to take a loan, the app lets users get instant credit on mutual fund investment and apply for loan against property up to 10 crore with the interest rate starting from 9 per cent per year.