As of May 19, the collective value of the Rs 2,000 notes in circulation dwindled to Rs 3.56 lakh crore from its previous Rs 3.62 lakh crore, recorded at the close of the preceding fiscal year on March 31, as indicated in the central bank's statement.

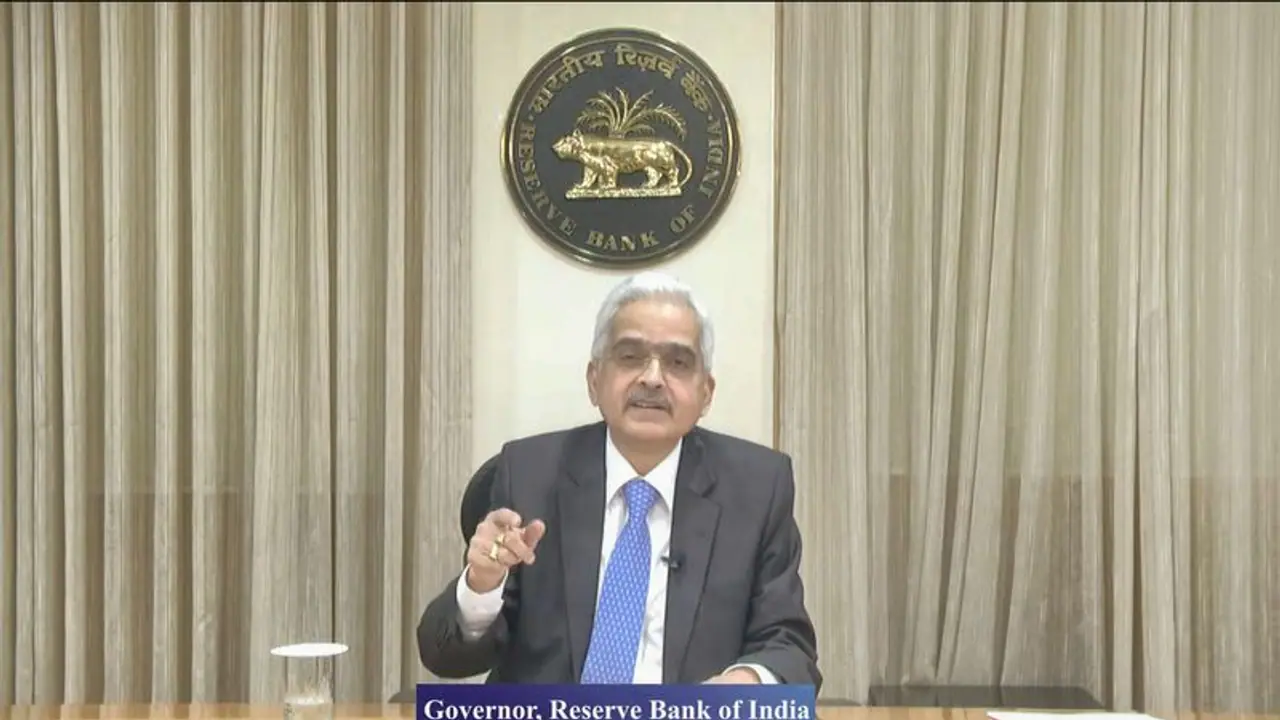

RBI Governor Shaktikanta Das on Thursday (August 10) held a MPC meeting and conveyed that the removal of the Rs 2,000 note is a short-term strategy. Governor Das emphasized that after the full removal of the Rs 2,000 denomination notes from circulation, the financial system will possess "sufficient liquidity."

Notably, the RBI had made a decision in May of the current year to phase out the Rs 2,000 denomination banknotes from circulation, stipulating that all such notes must be exchanged before the conclusion of September 30.

Governor Das shared that the RBI has enforced a 10% Incremental Cash Reserve Ratio (ICRR) on banks' deposits during the period of May 19 to July 28.

Cash Reserve Ratio (CRR) signifies the fraction of deposits which banks are required to maintain as cash with the central bank. It's important to note that banks do not accrue interest on the CRR balances that they hold with the RBI.

The Governor of the RBI described this action as a 'transitory measure' aimed at absorbing the surplus liquidity stemming from the retraction of Rs 2000 notes.

Explained: Why Digital Personal Data Protection Bill Matters

Recently, the RBI revealed that a substantial 88 percent of the nation's highest denomination, the Rs 2,000 currency notes, equivalent to a total of Rs 3.14 lakh crore, have been returned following the decision to withdraw them from circulation.

The RBI's declaration in May outlined the phased withdrawal of these high-value notes, allowing for exchange or deposit until September 30.

As of May 19, the collective value of the Rs 2,000 notes in circulation dwindled to Rs 3.56 lakh crore from its previous Rs 3.62 lakh crore, recorded at the close of the preceding fiscal year on March 31, as indicated in the central bank's statement.

The data collected from prominent banks indicates that approximately 87 percent of the banknotes received by these institutions were deposited, with the remaining 13 percent being exchanged for alternative denominations.