The central bank has raised the repo rate four times since May to 5.90 per cent. The most recent repo rate adjustment was made to keep inflation within the target range. The country is expected to have a real GDP rate of 7 per cent in the coming fiscal year.

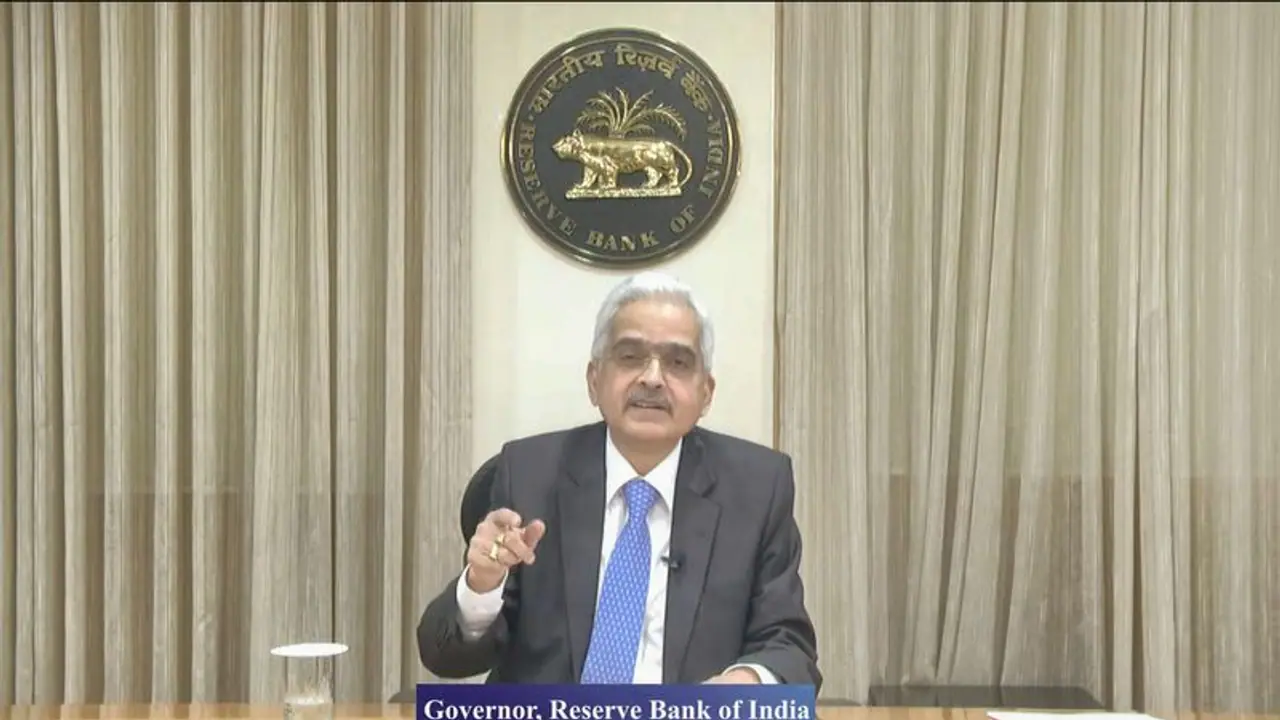

Reserve Bank of India (RBI) Governor Shaktikanta Das on Friday announced that the central bank's Monetary Policy Committee (MPC) raised the repo rate, or key lending rate, by 50 basis points (bps) to a three-year high of 5.9 per cent.

Since May, the central bank has raised the key policy rate by 140 basis points to 5.4 per cent to cool off the domestic retail inflation, which has remained above the RBI's upper tolerance limit of 6 per cent each month this year.

The RBI governor stated, "The world economy is at the eye of the storm, but India has withstood shocks during the last two years." The inflation rate is currently 7 per cent and is predicted to remain nearly 6 per cent through the year's second half.

Additionally, Das emphasised that the Gross Domestic Product (GDP) increased by 13.5 per cent year-over-year in the first quarter. "The MPC must continue to be vigilant and flexible in light of the current circumstances." He said that the real GDP growth in the first quarter of this year was still 13.5 per cent, although it was less than anticipated, perhaps the greatest among the major world countries.

Furthermore, the RBI reduced its GDP growth forecast for FY23 to 7 per cent from 7.2 per cent, citing aggressive tightening of monetary policies worldwide and a slowing in demand.

"The financial system remains intact, with improved performance parameters available for April and May 2022 indicates that the recovery in domestic economic activity remains firm, with growth impulses becoming increasingly broad-based," he added.

Since May, the central bank has raised the repo rate four times to the current 5.90 per cent. The recent repo rate adjustment was made to keep inflation levels within the target range.

Markets opened in the red ahead of the statement, with the Sensex at 56,254. The Nifty 50 index of the National Stock Exchange (NSE) was down 0.3 per cent at 16,776.

A Reuters poll conducted ahead of the statement found that a slim majority of economists expected a 50 basis point increase, with some expecting a smaller 35 basis point increase.

With a rise in the repo rate, EMIs for home, car, and personal loans are likely to rise. House, car, and personal loans will become more expensive as banks' borrowing costs rise, causing lending rates to rise.

Also Read: Govt hikes Q3 interest rates on some small savings schemes by up to 30 bps

Also Read: Rupee has held back very well against Dollar: Nirmala Sitharaman

Also Read: RBI's top priority is to tackle inflation: Governor Shaktikanta Das