Digital transactions in India jumped 19 times in last 7 years, says PM Modi launching RBI schemes

Synopsis

The two schemes launched today will expand the scope of investment in the country and make access to capital markets easier and more secure for investors, the PM said.

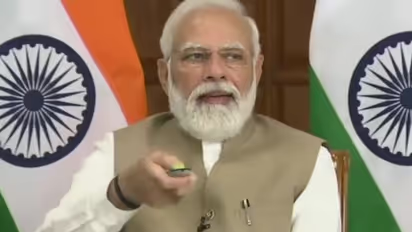

Lauding the use of Unified Payments Interface (UPI) across the country, Prime Minister Narendra Modi on Friday launched two innovative, customer-centric initiatives of the Reserve Bank of India (RBI), the Retail Direct Scheme and the Integrated Ombudsman Scheme. The schemes are aimed at easing access to the government securities market for retail investors, and for faster grievance redressal. He said the digital transactions in India have jumped 19 times in the last seven years.

The Prime Minister said while speaking at the launch of two customer-centric initiatives of RBI through video conferencing, “India has become the world's leading country in terms of digital transactions in a very short span of time. In just seven years, digital transactions in India have jumped 19 times. Today our banking system is operational 24 hours, 7 days and 12 months anytime, anywhere in the country.”

The Reserve Bank - Integrated Ombudsman Scheme aims to further improve the grievance redress mechanism for resolving customer complaints against entities regulated by RBI. The central theme of the scheme is based on ‘One Nation-One Ombudsman’ with one portal, one email and one address for the customers to lodge their complaints.

Also read: Now married daughters eligible for Uttar Pradesh govt jobs under deceased dependent quota

The two schemes launched today will expand the scope of investment in the country and make access to capital markets easier and more secure for investors, the PM said.

The PM said the RBI as a regulator has kept in mind the needs of the common investors. Accessing capital markets, including government securities, will now be easier and hassle free for small investors, he said. “This period of Azadi ka Amrit Mahotsav, this decade of the 21st century is very important for the development of the country. In such a situation, the role of RBI is also very big. I am confident that 'team RBI' will live up to the expectations of the country,” the Prime Minister said.

Speaking further he said, “Till 6-7 years ago, banking, pension, insurance, everything used to be like an 'exclusive club in India'. Common citizens of the country, poor families, farmers, small traders-businessmen, women, Dalits-deprived-backwards, all these facilities were far away for all of them.”