RBI revises GDP growth projection to 6.5% for FY24, pauses repo rate revision

Synopsis

The Reserve Bank of India has marginally raised the GDP growth projection for FY24 to 6.5 per cent from the earlier estimate of 6.4 per cent.

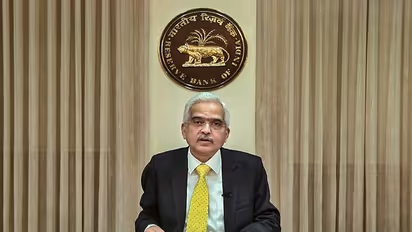

The Reserve Bank of India has marginally raised the GDP growth projection for FY24 to 6.5 per cent from the earlier estimate of 6.4 per cent. Announcing the bi-monthly monetary policy on Thursday, RBI Governor Shaktikanta Das said that the current financial year points towards softening of inflation. However, he reiterated that the war against inflation to continue until there is a durable decline.

The RBI also kept the repo rate unchanged at 6.5 per cent. The rate hike has been paused after six consecutive rate increases aggregating to 250 basis points since May 2022.

The RBI governor also touched upon the ongoing banking crisis in the United States, stating that the global economy was facing financial challenges in the wake of recent bank failures. While giving an assurance that the RBI has adopted a prudent approach towards regulations, Das said that the central bank is keeping a close watch on the turmoil in the banking sector in developed countries.

"Global economy is facing a renewed phase of turbulence. We are witnessing unprecedented uncertainties in geopolitics and the economy. The RBI will remain focused on the withdrawal of monetary policy accommodation. The banking and non-banking financial system remains healthy. The Monetary Policy Committee will not hesitate to take any action in future," the RBI Governor after hitting the pause button on the rate hike.

Here are more highlights of the RBI governor's briefing:

* RBI permits the operation of pre-sanctioned credit lines at banks to widen and expand the footprint of UPI

* RBI to set up a centralised portal to search across multiple banks for unclaimed deposits

* GCC countries to remain the main source of remittances; inward remittances touch an all-time high of USD 107.2 billion in 2022

* Economic activity remains resilient; economy expected to grow 7 per cent in FY23

* Policy decisions taken since May 2022 are still working through the system

* Core inflation remains sticky. Core inflation generally refers to inflation in manufactured goods.

* RBI to maintain agile approach for liquidity management; to manage govt borrowing programme in a non-disruptive manner

* CAD to remain moderate in Q4 FY23 and also in current fiscal year

* Indian Rupee moved in an orderly manner in FY23, RBI will remain watchful

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.