The UPI app uses phone number to make payments directly from bank accounts. Unlike BHIM, Tez gets a sluggish start. Mobile wallets have been there for a while, but the adoption has been very slow. UPI is easier, but not marketed well as of now.

Whenever a new payment service is launched in India, it's obviously compared to the likes of Paytm. So, when Google Tez was announced yesterday, it was instantly compared to how it could affect Paytm. It should be noted that they are different - Tez is a UPI-based payments app, just like the BHIM app, and allows transactions directly from your bank account. On the other hand, Paytm is a mobile wallet.

The UPI app uses phone number to make payments directly from bank accounts, without the need for account number, IFSC code and so on. The mobile number serves as a virtual payment address, and you will have to link your cards to the app. So, there is a Google pin that is generated and required each time you access the ap, and to make transactions you will require OTP and UPI pin.

Tez gets a sluggish start

Unlike BHIM, Tez gets a sluggish start. On the Android store, it is being rated 3.6, and many took to Twitter to vent out their frustration.

The app isn't friendly and the interface isn't self-explanatory is what we've been hearing. It's rather confsuisng and want users to discover features, rather than bringing them on a platter. It is highly speculated that Google was in a hurry to launch the app, before Facebook-owned WhatsApp launches its app.

Security

At the launch event, Google emphasised on security. However, it is now been revealed that the company may save your Aadhaar details, along with other private details. Take a look at this tweet below:

“In the event that you are a Recipient, you hereby consent Google to permit the Sender to store your information including bank account number and Aadhaar number on Tez for the purpose of sending you payments,” it reads.

The terms of service also add, "You hereby expressly consent to and permit Google, Group Companies and the Payment Participants' to collect, store and share such information including but not limited to the your personal information such as your name, address, Google Account or Payment instrument details, all transactions carried out through Tez or information with respect to third parties and the Recipients including bank account or Aadhaar details for the purposes mentioned in the Combined Tez Terms," it adds.

This means third-parties can save your Aadhaar details as well as Google can save the details on its server. One cannot deny that foolproof security is a myth and malicious minds could always find ways compromise on security. Despite Google's attempts, Android is known to be susceptible to malicious attacks, especially owing to fragmentation. And, who will take responsibility for the third-party breach.

Moreover, even if you delete your Tez account, Google will continue to use your VPA (virtual private address) and the mapped bank account details, points out NextBigWhat.

However, in response to Indiatimes, a Google spokesperson has said, "While NPCI guidelines permit payment by Aadhaar as a valid form of payment; we will not commence this feature until there is more regulatory and legal clarity. If at any time in the future, Tez supports this feature with notice to the user, we would only collect relevant data required for the purpose of supporting these payments as per applicable laws. The Terms of service refers to upcoming features in order to ensure that the user is aware."

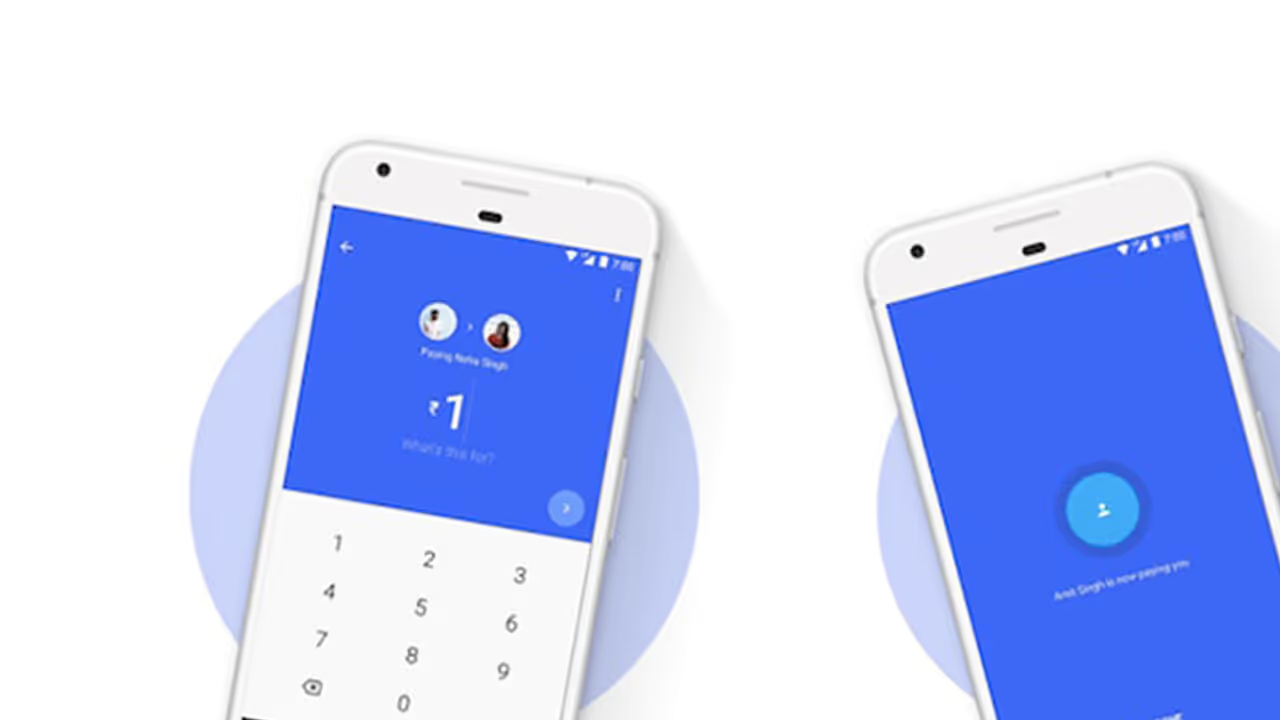

However, the company does add something called as 'cash mode' for those reluctant to share any details. In this mode, the transaction takes places between two devices within proximity using audio codes, without the need to share your mobile number or bank details. It appears to be something similar to Bluetooth transfer.

Will it give Paytm a run for its money

As aforementioned, Tez is a UPI-based app, unline Paytm that is a mobile wallet. You can add money in the wallet and don't have to link your bank account, whereas Tez makes the payment from the bank account. However, more services are slowly opening up with accepting UPI-based payments. There is an upwards trend in UPI based payment apps. Moreover, Google's move to pre-install the app in entry-level phones from Micromax, Lava and Nokia could could prove to be beneficial in awareness.

However, it is too soon to say if it will give digital wallets a run for its money. DD Mishra, Research Director, Gartner explains, "It (Tez) provides promising features which are in line with the requirements. It is multilingual and covers many major languages. It is too early to say whether it can be a game changer as evolution in this business is going to continue, but yes it has the capabilities to bring some disruption as of now. Moreover, Google’s information about an individual’s preferences can play a good role in enabling business to know their preferences and provide offers with interesting options. It tries to address security concerns as well. The mobile wallet industry too is evolving and we are at an interesting stage in this competition. Eventually, UPI payments will have an upper hand if it continues to remain free and provide better security, convenience and add more value added services. It will all depend on how fast Google can build ecosystem of partnerships around it and continue to sustain innovations."

"Google will need to keep adding new innovative services on top of it to continue to differentiate and build an ecosystem quickly to succeed. It is expected to face competition from UPI and wallet applications who are also working on similar initiatives," he added.

Mobile wallets have been there for a while, but the adoption has been very slow. UPI is easier, but not marketed well as of now. Moreover, UPI-based apps require one to connect their bank account to the phone, but how many users in India would be willing to connect their primary bank account with the phone?

Moreover, Paytm is in better position because of its extensive network, and the demonetisation gave it a much required push. On the other hand, UPI-based apps still require more used cases and awareness, and Google could help drive this change in Android-dominated India.