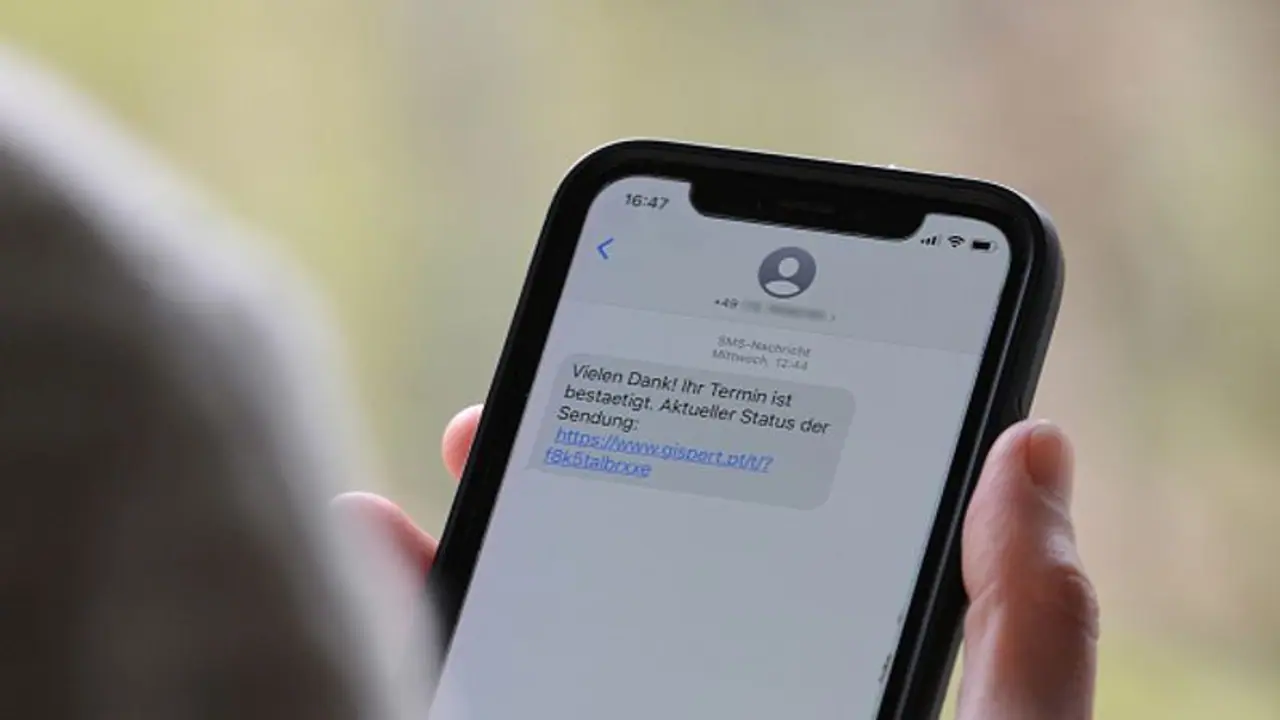

Many people have been receiving such messages on their phones for the past few weeks. These messages are available at the attached link. If you click on these, there is a high chance of losing money.

In an era where digital communication prevails, it's important to exercise caution when responding to unsolicited text messages or phone calls. Financial institutions, including banks, follow strict protocols and will never request your personal or financial information through these channels.

A prevalent scam making the rounds involves messages claiming that your credit card rewards points are on the verge of expiration. These messages, often accompanied by enticing links, have inundated phones across the nation over the past few weeks. Many people have been receiving such messages on their phones for the past few weeks. These messages are available at the attached link. If you click on these, there is a high chance of losing money. Recently, a 60-year-old lawyer from Bengaluru lost a staggering Rs 4.9 lakh after innocently clicking on a fraudulent link.

To safeguard against such scams, it's crucial to take proactive precautions:

1. Verify the source: Regardless of the medium, always identify the source before responding. Keep in mind that financial institutions will never ask for your personal information through text messages or phone calls.

2. Beware of Rewards Points Alerts: Be alert to messages warning about expiring credit card rewards points. Clicking on embedded links in these messages can lead to financial harm.

3. Exercise Caution with Messages and Calls: Maintain a cautious stance when dealing with unsolicited messages, emails, or phone calls, particularly if they request personal or financial information.

4. Source Authentication: When in doubt, take measures to confirm the legitimacy of any message or call. Visit your bank's official website for information, or reach out to them directly through their official contact details to validate any requests.

5. Avoid Clicking Unverified Links: Never click on links embedded in messages from unknown or unverified sources. Always verify that the website's URL matches the official one before proceeding with online transactions.

6. Enhance Device Security: Ensure your devices are fortified with up-to-date antivirus and anti-malware software. Maintain strong, unique passwords for online accounts, particularly those related to banking and finance.

By adhering to these guidelines, you can shield your personal and financial information from phishing scams and fortify your defences against financial fraud. In the digital realm, vigilance is your greatest ally in staying safe and secure.