XPeng expects its total revenue for the first quarter of 2025 to be between RMB 15 billion and RMB 15.7 billion, marking a year-on-year jump of up to 140% on the back of strong delivery numbers.

NYSE-listed shares of Chinese EV maker XPeng Inc (XPEV) fell nearly 7% by Tuesday noon despite the company reporting better than expected earnings in the fourth quarter and issuing a strong guidance for the first quarter of 2025.

For the fourth quarter (Q4) of 2024, the company reported total revenue of RMB 16.11 billion ($2.21 billion), marking a growth of 23.4% year-on-year (YoY), compared to an analyst estimate of RMB16.15 billion, according to FinChat data. Loss per ordinary share came in at RMB 0.73 ($0.10), lower than an estimated loss of $0.20.

The company expects its first quarter 2025 total revenue to be in the range of RMB 15 billion and RMB 15.7 billion, marking a YoY jump of up to 140%, on the back of strong delivery numbers.

The company expects to deliver between 91,000 and 93,000 electric vehicles (EVs) in the three months through the end of March, significantly higher than the 21,821 vehicles it delivered in the corresponding quarter last year.

XPeng CEO Xiaopeng He said the company is “well positioned” to significantly expand its market share in the EV industry in both China and abroad.

The firm officially entered the U.K. market earlier this year, marking its latest expansion effort in Europe. By the end of 2025, the company aims to establish a presence in 60 countries and regions.

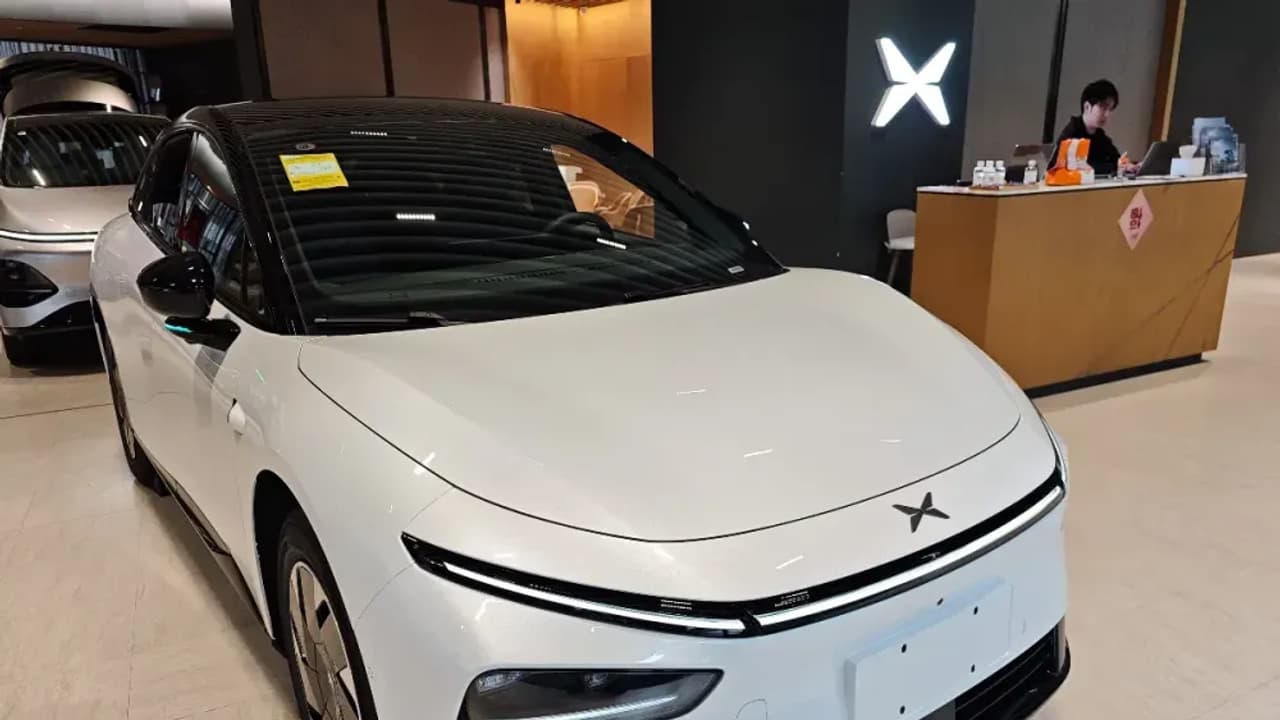

Meanwhile, Xpeng launched the updated versions of its G6 and G9 SUVs earlier this month in China.

On Stocktwits, retail sentiment shifted from “bullish” to “extremely bullish” (79/100), coupled with extremely high message volume.

NYSE-listed shares of XPeng have risen over 100% in 2025 and by over 130% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Exchange Rate: 1 RMB = $0.14