Both companies have indicated they will likely pursue legal action once the deal is formally blocked.

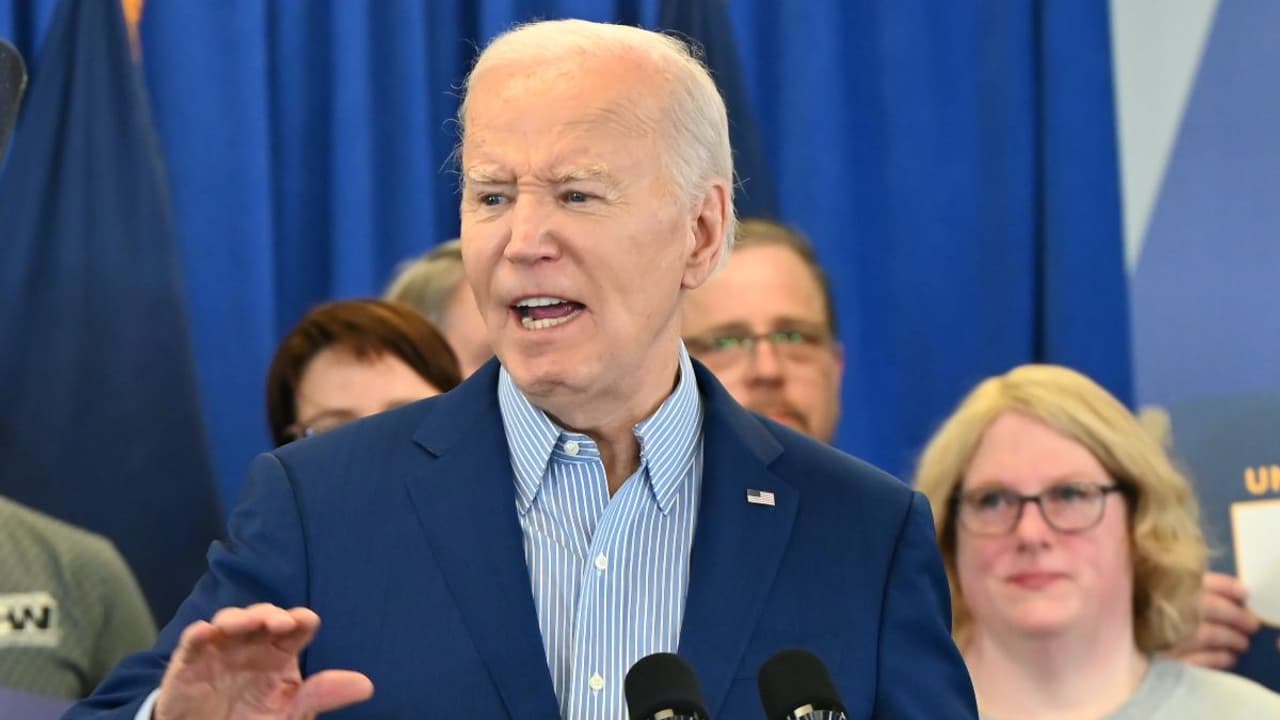

U.S. Steel (X) stock dropped as much as 8% in pre-market trade on Friday after reports emerged that President Joe Biden will be blocking its acquisition by Japan’s Nippon Steel.

The White House plans to announce the decision later on Friday, Bloomberg reported, citing sources.

The $14.1 billion deal has faced considerable pushback from the government and the United Steelworkers union, citing national security concerns.

Sources told the Washington Post that Biden opted to kill the deal despite intense efforts by some of his senior advisers to sway him in recent days, including concerns that rejecting a sizable investment from a top Japanese corporation could damage U.S. relations with Japan.

While Biden has been vocal about his opposition to the deal, propagating that U.S. Steel should remain domestically owned and operated, the White House is yet to take an official stance on the acquisition.

Both companies have indicated they will likely pursue legal action once the deal is formally blocked.

The White House had not issued any formal statement at the time of writing.

On Stocktwits, retail sentiment around U.S. Steel dipped to a year-low in the ‘extremely bearish’ zone from a tepid ‘neutral’ a day ago, as chatter surged to ‘extremely high.’

One retail investor on the platform expressed confidence that the deal would eventually get approved once the companies take the issue to court.

However, another said that it’s unlikely that anyone other than Nippon Steel would want to buy U.S. Steel.

Some even expressed solidarity with the decision to keep U.S. Steel American-owned.

Reports about Biden blocking the deal came after the Committee on Foreign Investment in the United States (CFIUS) was unable to decide whether the deal posed a national security risk, leaving the final decision to the president.

On Monday, Nippon Steel made a bid to overcome Biden’s opposition, offering the government an effective veto over any reduction in U.S. Steel’s “production capacity.”

Yet even that gambit has fallen short if reports hold.

If Biden does reject the deal, the collapse of Nippon Steel’s proposed $14.9 billion acquisition would represent a victory for United Steelworkers union president David McCall.

Amid the acquisition controversy, U.S. Steel’s stock dropped more than 30% in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: BitFuFu Stock Soars After Securing A Fleet Of 80,000 Miners From Bitmain: Retail Remains Unconvinced