The power purchase agreement (PPA) between the two companies represents an overall volume of 1.5 Terawatt hours (TWh).

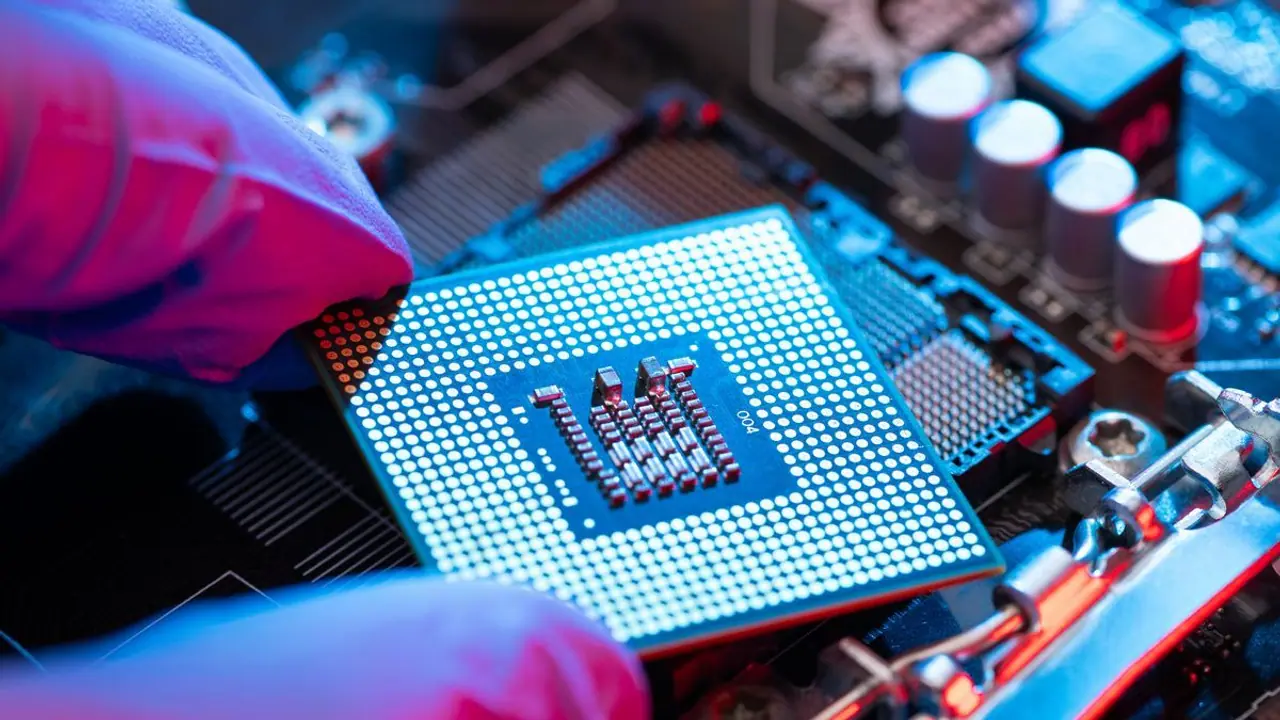

Shares of STMicroelectronics NV (STM) were in focus in pre-market trade on Wednesday after the semiconductor manufacturer entered into a 15-year renewable energy deal with France-based TotalEnergies (TTE).

The power purchase agreement (PPA) between the two companies represents an overall volume of 1.5 Terawatt hours (TWh).

TotalEnergies’ two recently constructed solar and wind farms of 75-megawatt capacity will be used to power STMicroelectronics’ operations in France.

The company also noted that it already has such PPAs for its facilities in Italy and Malaysia.

“This first PPA in France marks yet another important step towards ST’s goal of becoming carbon neutral in its operations by 2027, including the sourcing of 100% renewable energy by 2027,” said Geoff West, EVP and Chief Procurement Officer at STMicroelectronics.

Retail sentiment on Stocktwits around the STMicroelectronics stock surged on Wednesday, entering the ‘extremely bullish’ (96/100) territory, which is a one-year high.

Message volume picked up as well, hovering in the ‘extremely high’ zone at the time of writing.

One user expressed a bullish outlook on the STM stock, noting that its valuations look “cheap.”

Earlier last week, analysts at Barclays downgraded the STM stock to ‘Underweight’ from ‘Equal Weight’ over concerns that U.S. export restrictions could split the global semiconductor industry in two, according to TheFly.

The brokerage observed that STM needs to grow in China to meet its medium-term targets.

STM’s stock price has declined nearly 27% over the past six months, while its one-year performance is worse, with a fall of over 45%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<