The timelines for the contracts span from February 2025 to September 2029, with an additional five-year option period that could extend a contract through Sept. 30, 2034.

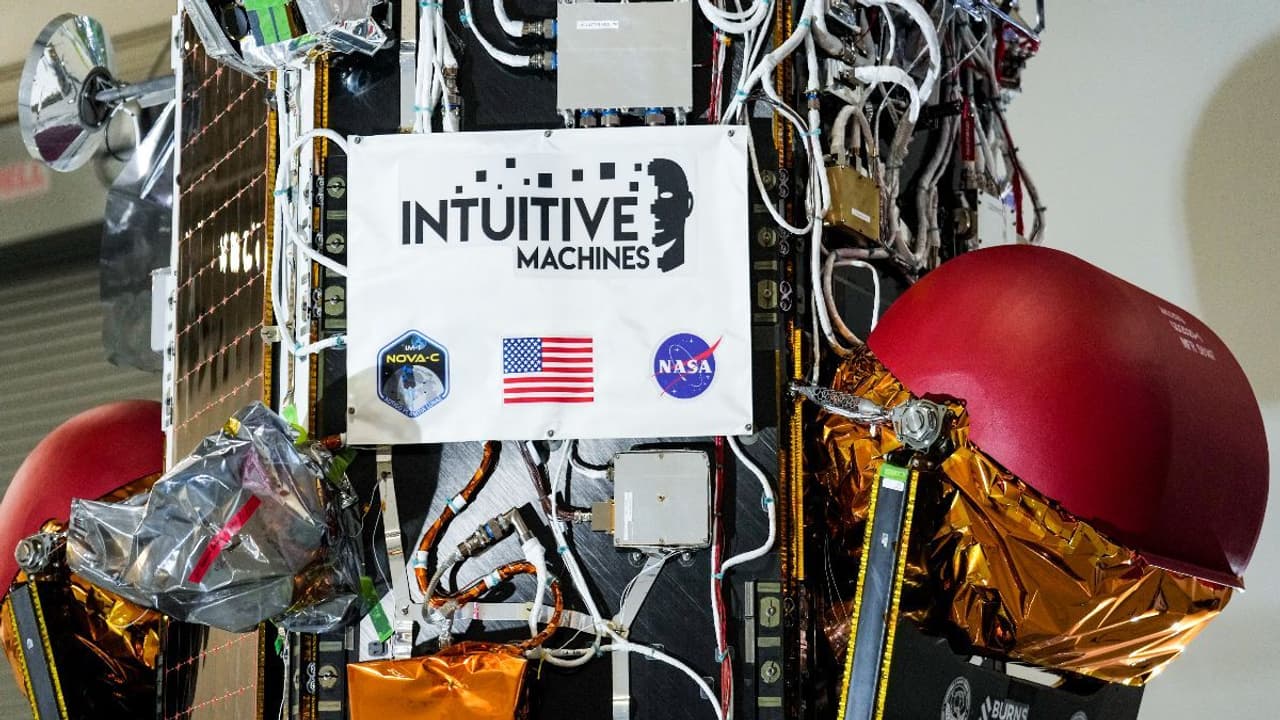

Shares of space exploration company Intuitive Machines Inc (LUNR) surged over 4% on Monday after the firm revealed it has secured additional contracts from NASA’s Near Space Network for Direct-to-Earth (DTE) services.

The company explained that DTE communication and navigation services are important for enabling missions to exit Earth’s orbit, reach lunar destinations, and explore deep space.

Intuitive Machines’ contracts include two DTE services that offer enhanced data transmission capabilities and autonomous operations and address mission needs for highly elliptical orbits and deep space operations.

The company stated that these awards are firm-fixed-price, indefinite-delivery/indefinite-quantity task orders “designed to bolster NASA’s Lunar Exploration Ground Segment.”

Intuitive Machines CEO Steve Altemus said the new awards complement the firm’s existing NSN contract and will expand its space communications and navigation service offerings.

“They position us to capitalize on the $4.82 billion maximum potential value of the NSN contract, while supporting NASA’s Artemis campaign and commercial endeavors to expand the lunar economy,” he said.

The timelines for the contracts span from February 2025 to September 2029, with an additional five-year option period that could extend a contract through Sept. 30, 2034.

On Stocktwits, retail sentiment inched up into the ‘neutral’ territory (51/100) from ‘bearish’ a day ago.

Despite the rise in stock price, retail chatter on Stocktwits indicated a mixed take on the shares’ potential.

Earlier this month, the firm was in the news after it announced the pricing of its upsized offering of over 9.52 million shares at a price of $10.50 per share.

Notably, the stock has more than quintupled since the beginning of 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<