otwithstanding Gorilla Tech’s stellar run seen since 2024, retail thinks the stock is grossly undervalued.

Gorilla Technology Group, Inc. (GRRR) shares have performed well recently, rising over 95% in the past six sessions. Retail is undeterred by the exuberance and is positioning for more gains.

The U.K.-based artificial intelligence (AI)-driven industrial Internet of Things (IIOT) solutions provider saw its stock surge by 235% in 2024. The uptrend continued unabated in the new year.

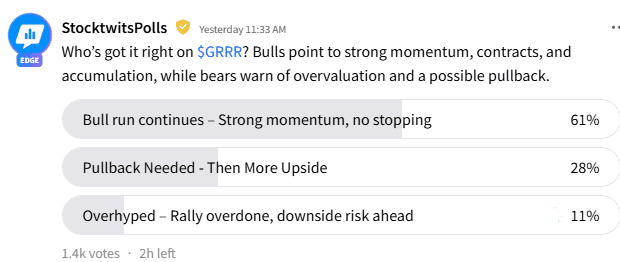

A Stocktwits poll asking platform users about their views on the recent rally received 1,400 responses. A majority (61%) see no stopping and expect the bull run to continue with strong momentum.

Another 28% expect a pullback before the rally resumes and only 11% called Gorilla Tech an “overhyped” stock, positioned for downside ahead.

A watcher who commented on the poll said Gorilla Tech stock is undervalued by at least five to 10 times. Another user said that despite a recent $1.8 billion contract win, the company’s valuation is only $750 million.

On Monday, Gorilla Tech announced that it has secured a $1.8 billion agreement to lead Thailand's energy digitization and infrastructure transformation initiative.

The company expects revenue to scale progressively with a significant ramp expected from 2026-2027 as full operations begin, given the scale and complexity of the program.

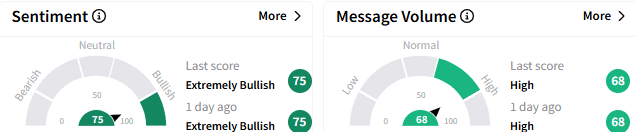

Sentiment among retail traders on the platform remained ‘bullish’ (73/100), with the message volume staying at ‘high’ levels.

The stock has nearly 18,000 watchers on Stocktwits, and early Thursday, it was among the top 10 trending stocks on the platforms.

Gorilla Tech’s stock fell 2.84% to $40.72 early Thursday, and if the losses carry over into the regular session, it would mark the first retreat in seven sessions.

The stock is up 132% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<