This is in addition to the previous share buyback authorization, which still has $7.6 billion remaining, the company said, noting that it is working to deliver value to its shareholders.

Applied Materials Inc. (AMAT) announced a fresh $10 billion share buyback authorization in a shareholder meeting held last week.

The company said this is in addition to the previous share buyback authorization, which still has $7.6 billion remaining, noting that it is working to deliver value to its shareholders.

Applied Materials also approved a 15% increase in the quarterly dividend, marking the eighth consecutive year of hikes. As a result, eligible shareholders are entitled to a dividend of $0.46 per share, payable on Jun. 12, 2025, with the record date set to May 22, 2025.

“The dividend increase and new share repurchase authorization we are announcing today indicate our confidence in Applied’s business prospects and bolster our ability to distribute excess cash to shareholders in the coming years,” said Brice Hill, Applied Materials’ CFO.

Further, the company announced that it has secured a new $2 billion revolving credit facility from Bank of America, replacing a $1.5 billion line of credit.

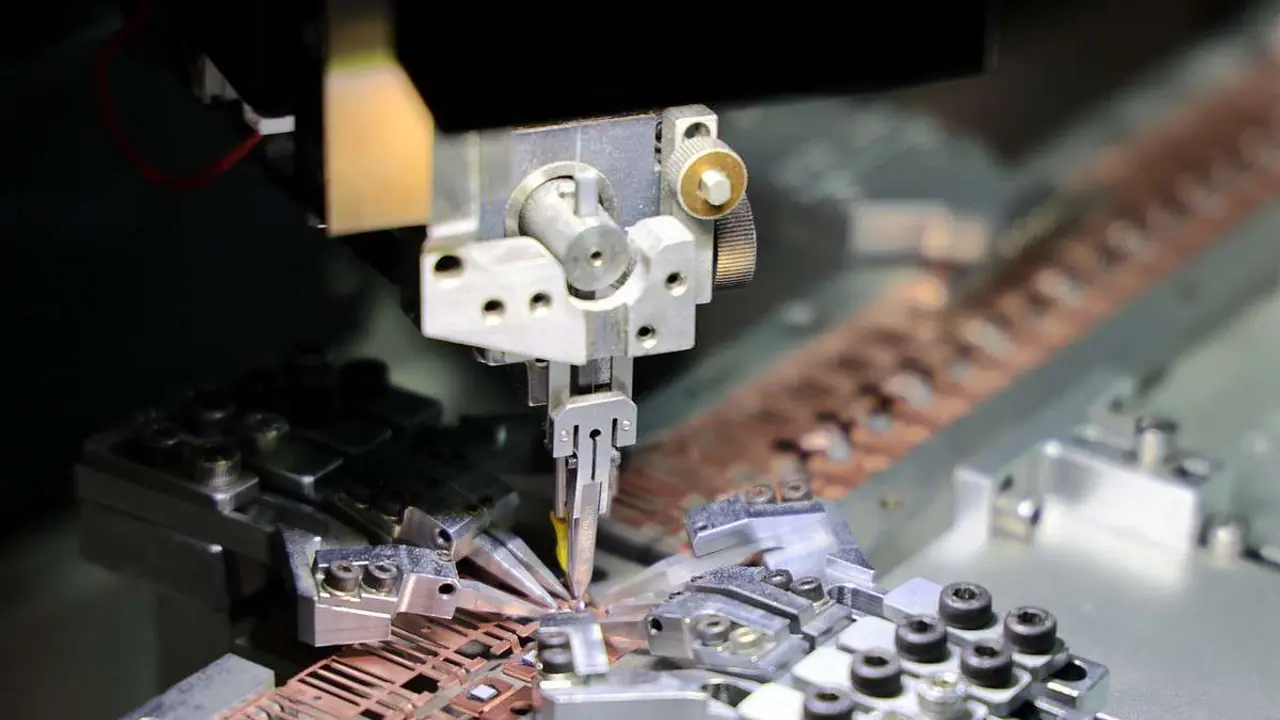

The California-based equipment supplier for semiconductor manufacturing has a market capitalization of $126.5 billion.

Despite the dividend hike and share buyback authorization, Applied Materials’ stock fell nearly 3.7% amid a broader selloff in the equity markets.

However, retail investors on Stocktwits shrugged off the decline, with sentiment remaining in the ‘bullish’ territory at the time of writing.

Message count witnessed a 750% surge in the last 24 hours.

One user thinks the dividend hike and share buyback are “exactly” the kind of news investors wanted.

Applied Materials’ stock is down nearly 7.8%, flirting with 52-week lows. Over the past year, the stock has lost more than a quarter of its value.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<