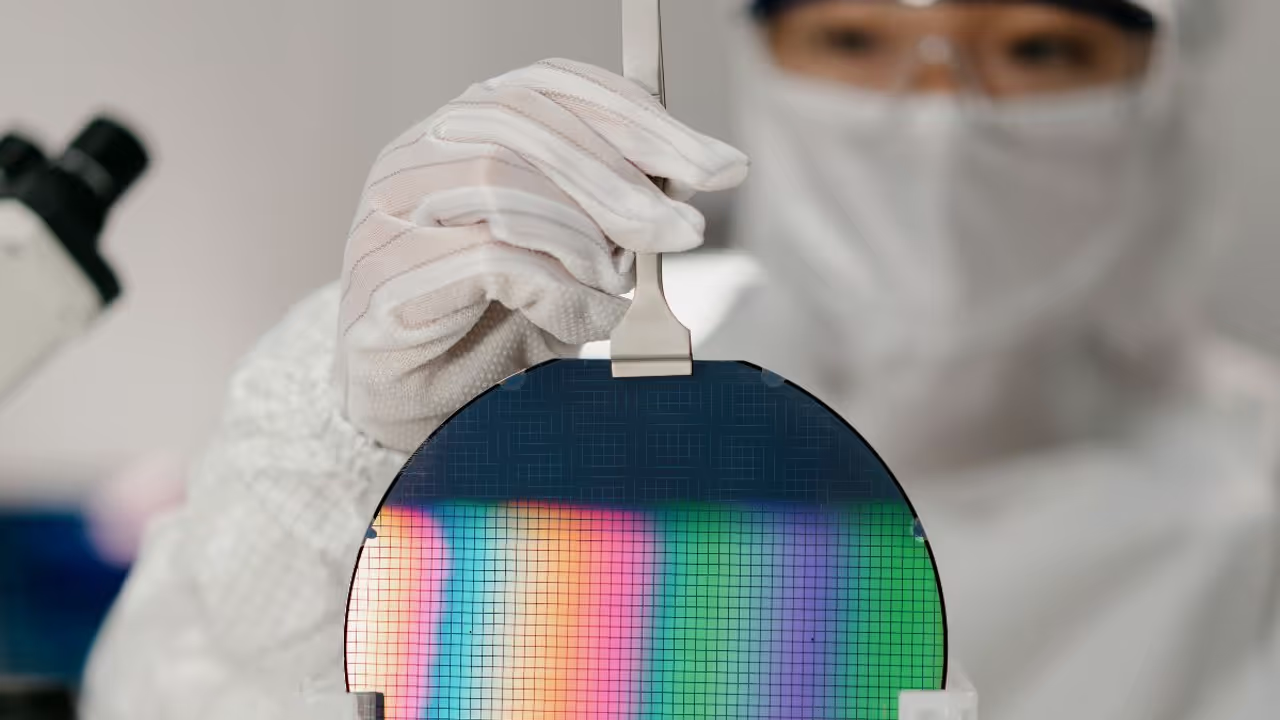

This move aligns with the company’s October guidance to target growth markets like AI, gallium nitride semiconductors, and memory devices.

Shares of Aehr Test Systems ($AEHR) soared nearly 27% by midday Monday, reaching more than a one-month high after the company announced its first order from an artificial intelligence (AI) customer.

The stock was among the top trending tickers on Stocktwits after the news.

Valued at over $10 million, the deal includes multiple high-power FOX-XP wafer-level test and burn-in systems, along with proprietary WaferPak Contactors.

The company plans to ship the first system immediately, with all deliveries expected to be completed within 90 days.

This marks Aehr’s entry into the fast-growing AI processor market, where its testing technology can ensure the reliability of chips before their integration into devices, according to the company.

Retail sentiment around the stock surged to ‘extremely bullish’ from ‘neutral’ as chatter rocketed to ‘extremely high’ levels from ‘low’ a day ago, marking record highs in retail activity.

Users applauded the company for entering a new market that can be a robust source of revenue. Some expect the stock to gain through the week.

This move aligns with the company’s October guidance to target growth markets like AI, gallium nitride semiconductors, and memory devices.

During its first-quarter earnings call for fiscal 2025, CEO Gayn Erickson outlined Aehr’s strategy to expand beyond its core semiconductor testing business.

Despite reporting a 36% YoY revenue decline to $13.1 million last quarter, the company reaffirmed its forecast of at least $70 million in total revenue for fiscal 2024, with net profit before taxes expected to exceed 10%.

Approximately 85% of Aehr’s forecasted revenue this year will come from wafer-level burn-in, a key focus of its portfolio. Its acquisition of Incal is also projected to contribute to packaged-part burn-in testing, which will account for the remaining 15% of revenue.

Although Aehr has gained significantly today, the stock remains down 41% year-to-date, leaving room for further recovery as it executes on its growth initiatives.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: Red Cat Holdings Stock Soars On Partnership With Palantir Ahead Of Q2 Earnings: Retail Suspects The Timing